Mystery deepens over Council decision as FOI response reveals only 4 empty units may be affected.

11-15 Front Street

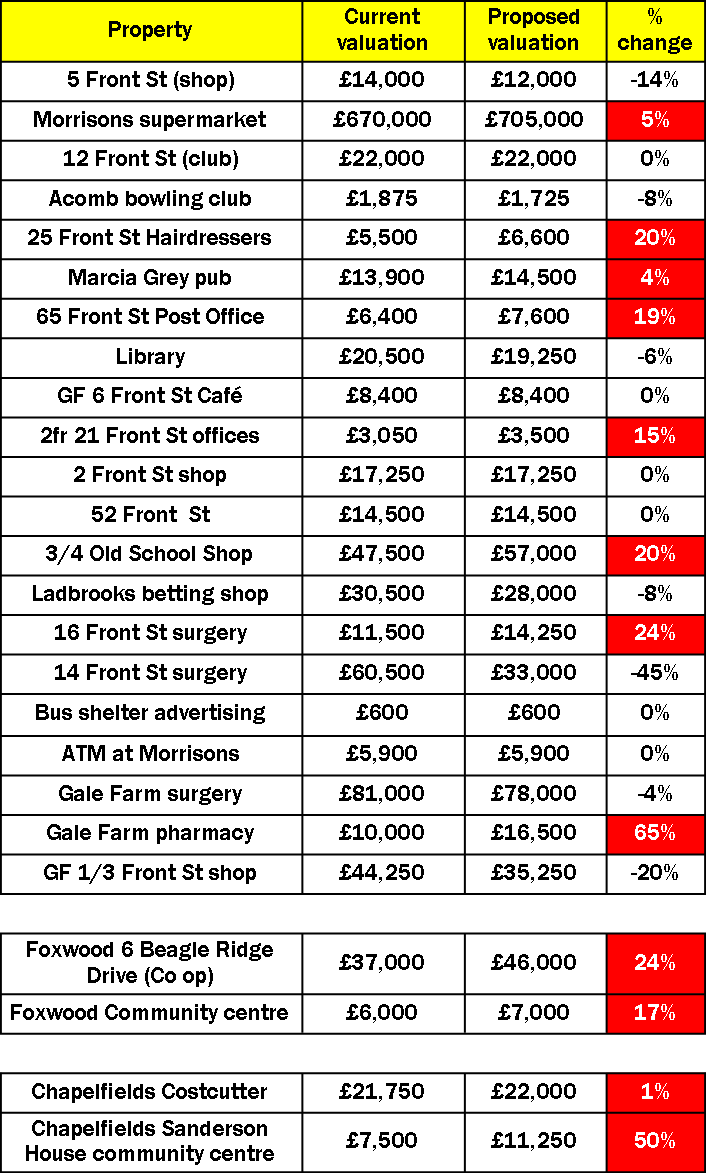

The Labour Cabinet came under fire earlier in the month when it nodded through a proposal to give 50% Rates relief to any empty property in the “Acomb” area that was brought back into use.

Now the Councils list of empty retail (and commercial) properties in the YO24 and YO26 area has been published.

The list reveals that the main “problem” property (which is also very prominent) is 11 – 15 Front Street (part of which was formerly occupied by Superdrug). We understand that the property was sold be the Coop Bank a couple of years ago and is now understood to be back on the market.

Many will feel that this site needs redeveloping although what Rates discount would apply to new properties remains unclear.

As we have said before, there is a good case for improving on the government scheme which gives a Rates discount on re-occupied properties which have been empty for more than 12 months.

However if discounts apply from day one then this could rightly be regarded as unfair competition by existing traders.

It was pointed out at the time, that the area of benefit was ill defined and – if it was intended to boost the Front Street area – then it needed to be focussed on longer term empty properties.

With the recession now ending it appeared that most shops had either been occupied or were under offer. Some prime sites are now understood to be changing hands at a premium.

The LibDems submitted the following comments to the meeting earlier in the month

The Liberal Democrat Group was disappointed that the Labour Cabinet did not support a comprehensive regeneration proposal for Front Street at July’s full Council.

This proposal, which uses powers given to Councils by the Coalition Government, seems to have been cobbled together in a rush – as the rewrites in the paper published on the council website indicate. Key details such as which exact area the discount will apply within are missing (the council papers refer only to “Acomb”). The paper does not explain why the scheme is restricted to retail premises (the similar Government scheme refers to all businesses) and it does not explain how temporary ‘pop-up’ units will affect entitlements.

We would also like further information on how the process will work given the September deadline for applications. The concern that the discount could be used by national chains, moving into prime sites immediately as leases become available, is not addressed and no alternative proposals are considered e.g. focusing discounts on properties which have been empty for over 3 months (business rates are not payable on a commercial property for the first 3 months that it is empty).

The Council needs to act promptly to clear u the confusion caused by its decision

Cllr Sue Hunter, Liberal Democrat councillor for Westfield, is calling on the Council to ensure progress is maintained on the regeneration of the Front Street area.

Cllr Sue Hunter, Liberal Democrat councillor for Westfield, is calling on the Council to ensure progress is maintained on the regeneration of the Front Street area.

The York Council recently announced that it will invest in the Front Street area and the expectation is that experts will recommend a way forward. Although the shopping area has had a boost over recent years, with the Acomb Alive traders organisation holding a series of events, many feel that a change to the physical layout of the precinct will be necessary to tempt larger numbers of shoppers back to the village.

The York Council recently announced that it will invest in the Front Street area and the expectation is that experts will recommend a way forward. Although the shopping area has had a boost over recent years, with the Acomb Alive traders organisation holding a series of events, many feel that a change to the physical layout of the precinct will be necessary to tempt larger numbers of shoppers back to the village.

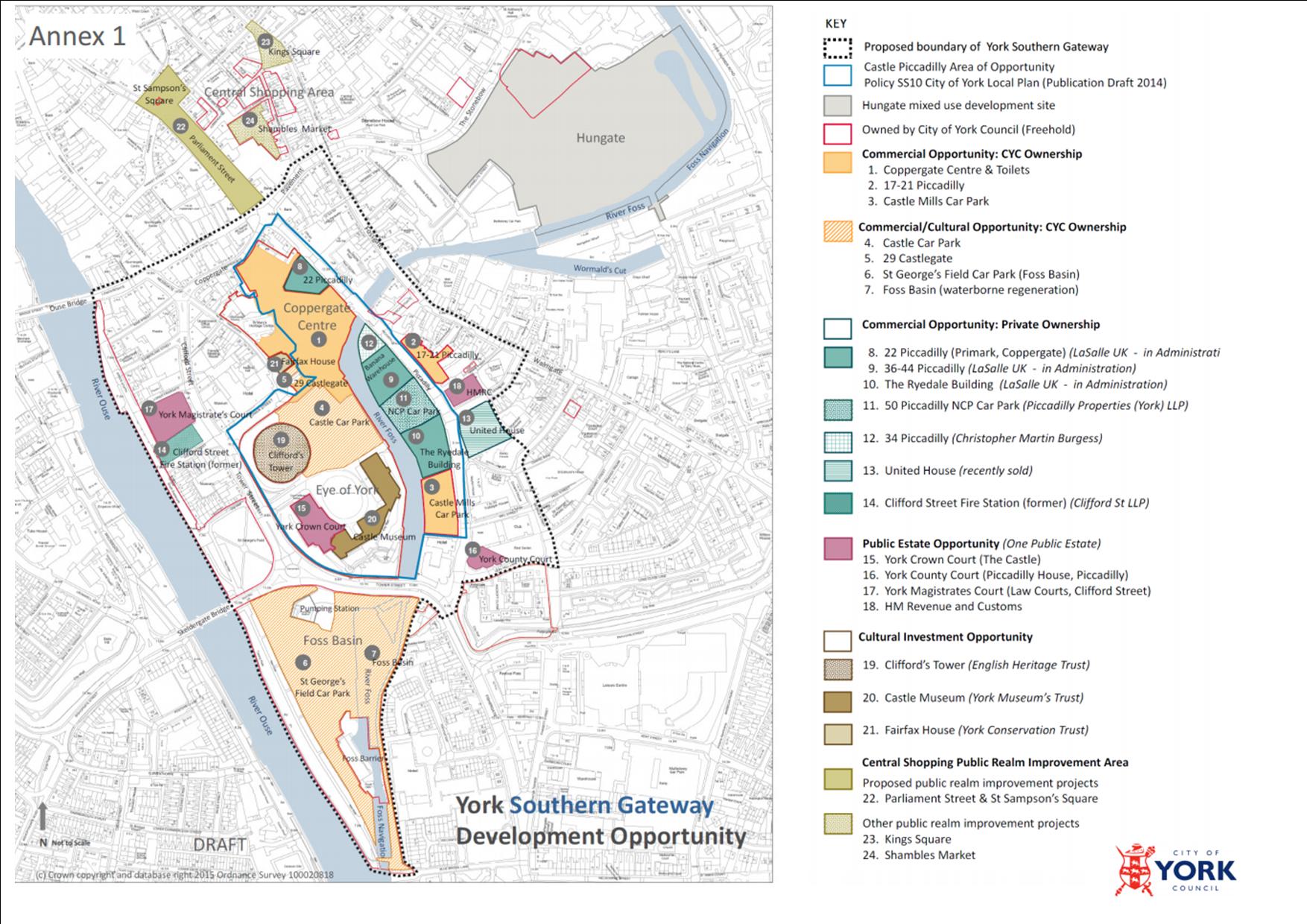

The report on plans to devolve responsibility for economic development activities, in the

The report on plans to devolve responsibility for economic development activities, in the