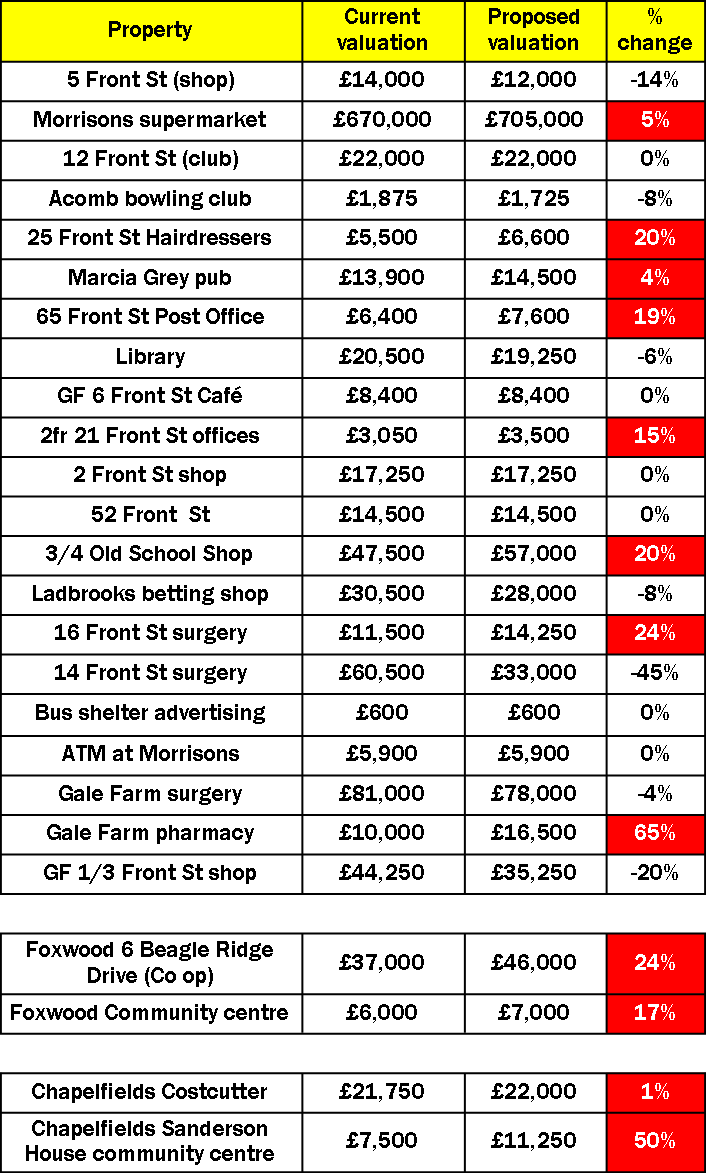

Rates, rent and profit share payments due in the next few days.

Spark April 2018

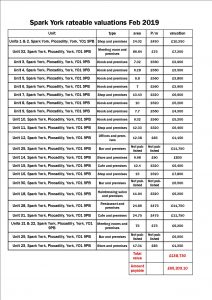

The valuation office has completed its assessment of the rateable value of the Spark container village on Piccadilly.

Figures published on their web site suggest a total valuation of £138,730.

In the normal course of events this would bring around £65,000 into the City’s coffers helping to offset the additional costs of street cleaning, refuse collection, policing etc. associated with developments of this sort.

Increases in rateable value these days bring an immediate boost for Council finances under rate retention schemes (The Council’s rate support grant has consequently been reduced to zero this year).

But will there be a boost in this case?

Valuations were apparently requested on a per container basis. This means that none of the 25 units has a rateable value of more than £12,000.

Rating list

Government regulations on rate relief for small businesses say “You will not pay business rates on a property with a rateable value of £12,000 or less”.

So, unless an occupier has a second business property elsewhere, then they may not pay any rates at all.

Empty properties are exempt from Business Rates for 3 months.

Some of the alcohol selling units on the site are said to be highly profitable. No doubt other traders operating nearby will question whether this is fair competition.

York Council officials are staying tight lipped about whether they anticipated this development.

The original Spark business pitch to the Council talked about a £71,000 profit each year. Part of this was to be used to repay the Council’s initial investment in new utility infrastructure. The first payment toward paying off this debt is due in a little over 6 weeks’ time, together with the Council’s share of what Spark claim is a “£1.5 million profit”

NB In August 2018 the Council refused a planning application from Spark to omit the wooden cladding for the containers which they had suggested as part of the original application.

Spark is currently closed on Mondays and Tuesdays. Spark list only 4 retailers who currently operate from the containers. There are also 7 food and drink outlets