An initial £17.5m relief has been applied to rates bills which arrive with York businesses this week.

Having joined local and regional partners in making the case to central government for further business rates relief, City of York council delayed issuing rates bills until after the budget announcement on Wednesday 3 March.

The Chancellor announced that eligible retail, hospitality, leisure and nursery business will receive a rates discount of:

- 100% for the first three months, totalling £17.5m for eligible York businesses

- Up to 66% for the remainder of the 2020/21 financial year

The total value of the rates relief will depend on how many businesses reach the discount cap set by the government:

For eligible retail, hospitality, leisure properties the £2m for businesses that were required to close as at 5 January 2021, and up to £105,000 for business permitted to open at that date.

For eligible nursery properties the relief will be capped at £105,000 per business, regardless of the open or closed status.

Following government guidance, eligible businesses will receive two bills. The first will show a 100% discount from April 2021. The council will then issue an adjusted bill from 1st July 2021 showing 66% discount for the period from 1st July 2021 to 31st March 2022.

Businesses which do not have access to their registered premises to collect their bill can contact the rates team by e-mail at business.rates@york.gov.uk.

Businesses that wish to opt out of the Retail, Hospitality & Leisure Rate discount scheme, or Nursery discount scheme may do so by contacting business.rates@york.gov.uk before 30th April 2022. Please note that any business opting out of this scheme cannot withdraw their refusal for either all or part of the financial year.

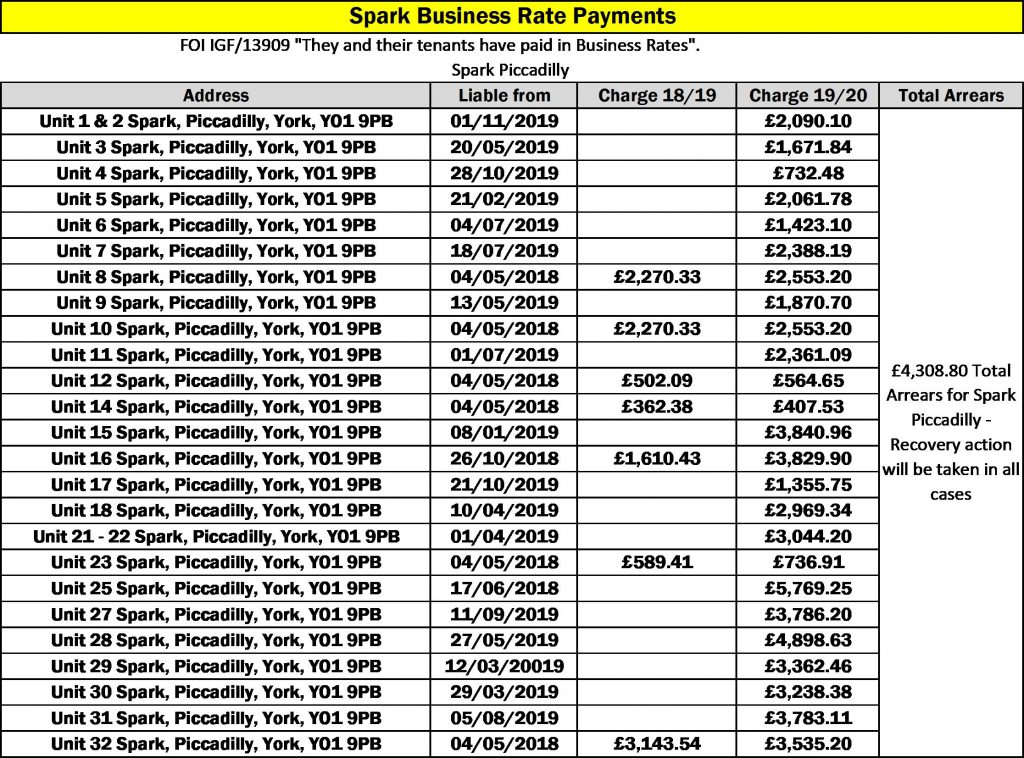

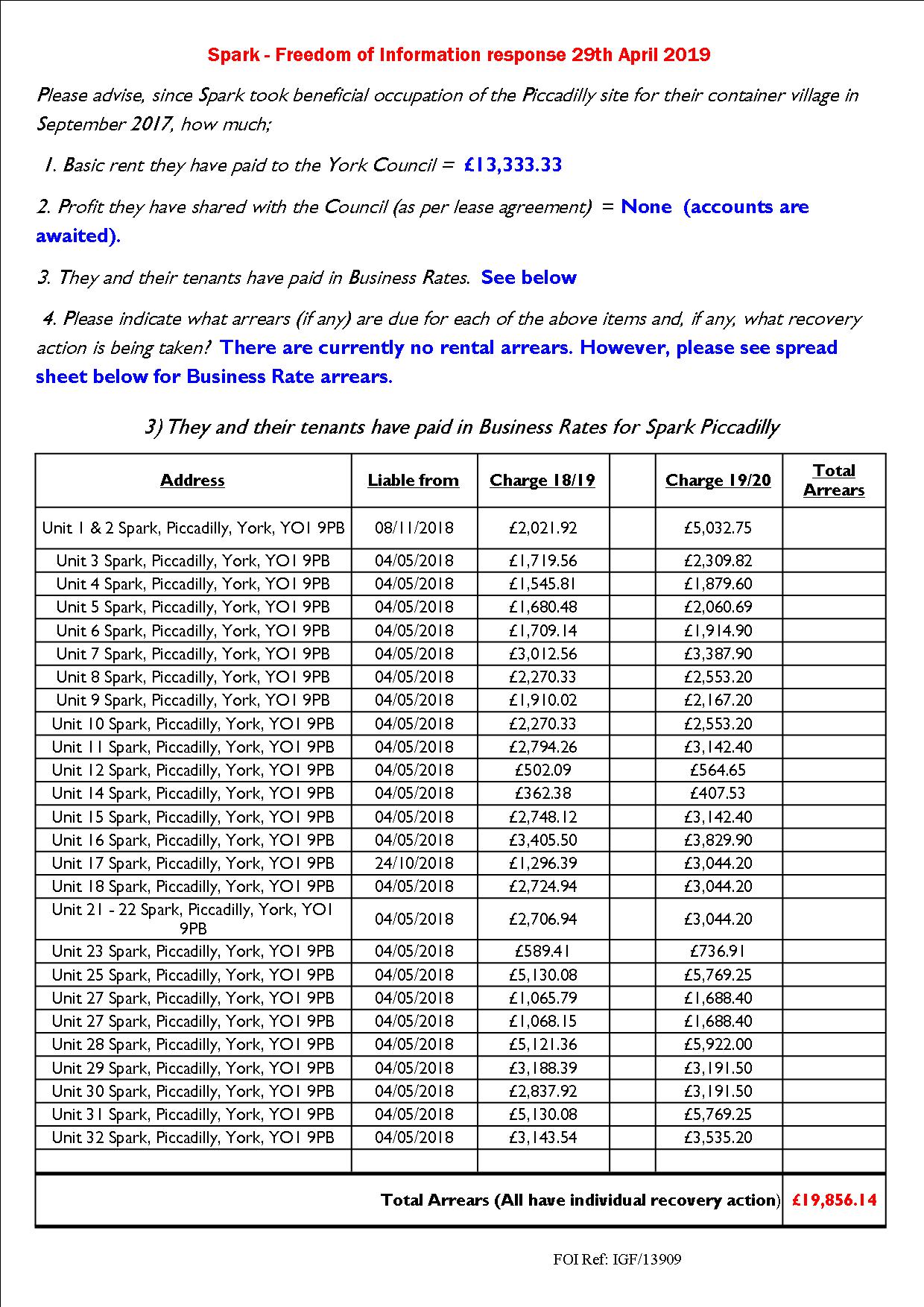

Looks like the Valuation Office has started to issue decisions on the rateable value of units at Spark on Piccadilly.

Looks like the Valuation Office has started to issue decisions on the rateable value of units at Spark on Piccadilly.

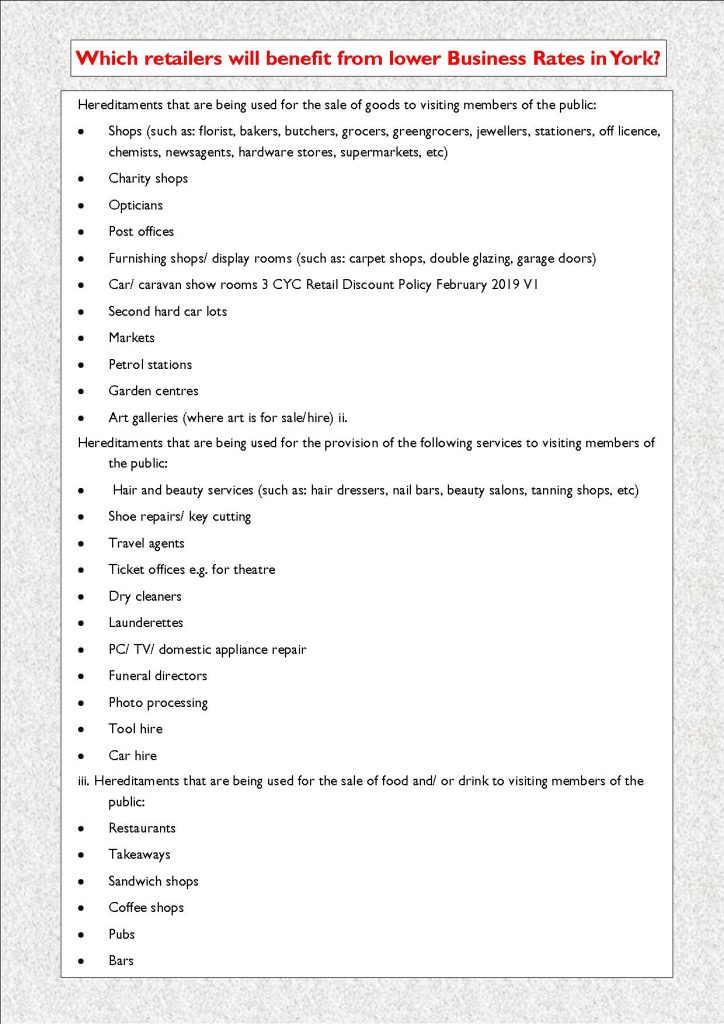

The Liberal Democrats have published a comprehensive blueprint for replacing the broken business rates system, cutting taxes for businesses by 5% in

The Liberal Democrats have published a comprehensive blueprint for replacing the broken business rates system, cutting taxes for businesses by 5% in