Council reveals who pays the most and least in rates

Tesco has largest rates bill in York

The Government scheme to reduce business rates by 33% for medium sized retailers has been approved. New bills are expected to be sent out shortly.

The decision comes as the Council lifts the veil on business rates (NNDR) in York. A report to a meeting next week says that 2000 local businesses are entirely exempt from paying rates. (Businesses with a rateable value of less than £12,000 are exempt from paying rates).

The bottom 50% of businesses pay an average of less than £1000 per annum.

The biggest bill is paid by Tesco which alone has a bill in York of over £3 million.

7 of the top 10 charges are for superstores, including those at Vangarde.

The top 3 non-retail rates bills are for Nestle (£1.4m), Defra (£930k) and CYC’s West Offices (£730k).

Hotels are large contributors, The Grand having a net charge of £680k, The Principal paying £547k and the StayCity Aparthotel on Paragon Street contributing £343k.

Within the city centre, the highest charges are paid by Marks and Spencer for their Parliament Street store (£527k), Primark (£366k) and Boots (£355k).

The highest rateable value of £7m is for the University of York, although the University is a charity and receives 80% relief on its liability.

Coney Street and Parliament Street still have the highest rateable values. Click here to see a list of the values in each City Centre street.

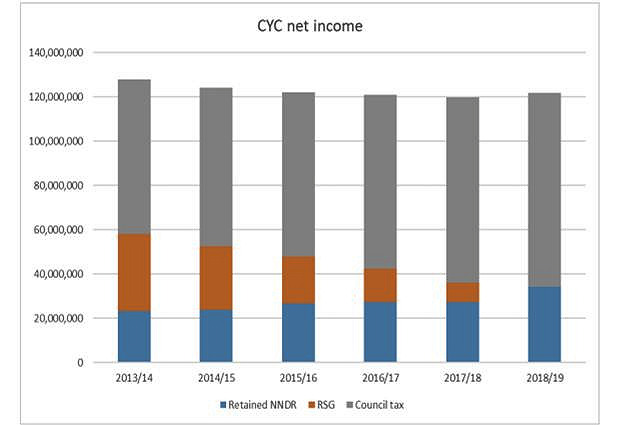

The York Council is increasingly dependant on business rate income to fund public services.

The report reveals that, although rates are payable on empty properties (after 3 months), the BHS store on Coney Street has been exempted from the charge by the Valuation Office. There are other exemptions mainly for charities and amateur sports clubs.

Business rate levels are set by central government. Income is shared between the local authority and central government.

28% of the York Council’s budget is now funded from business rates .

The Council is expected to submit an expression of interest in the new “Future High Street Fund” at a meeting being held on 22nd March.

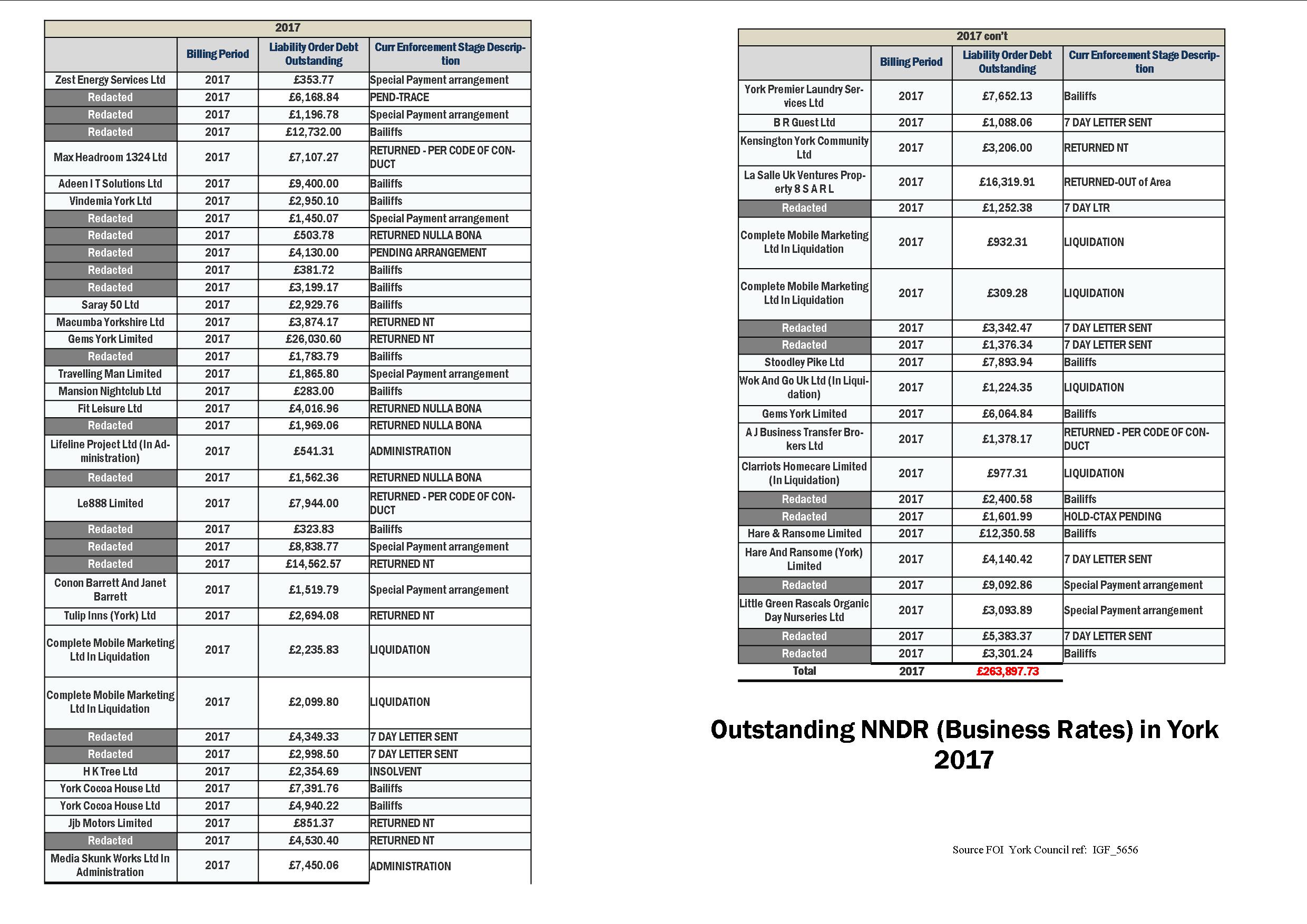

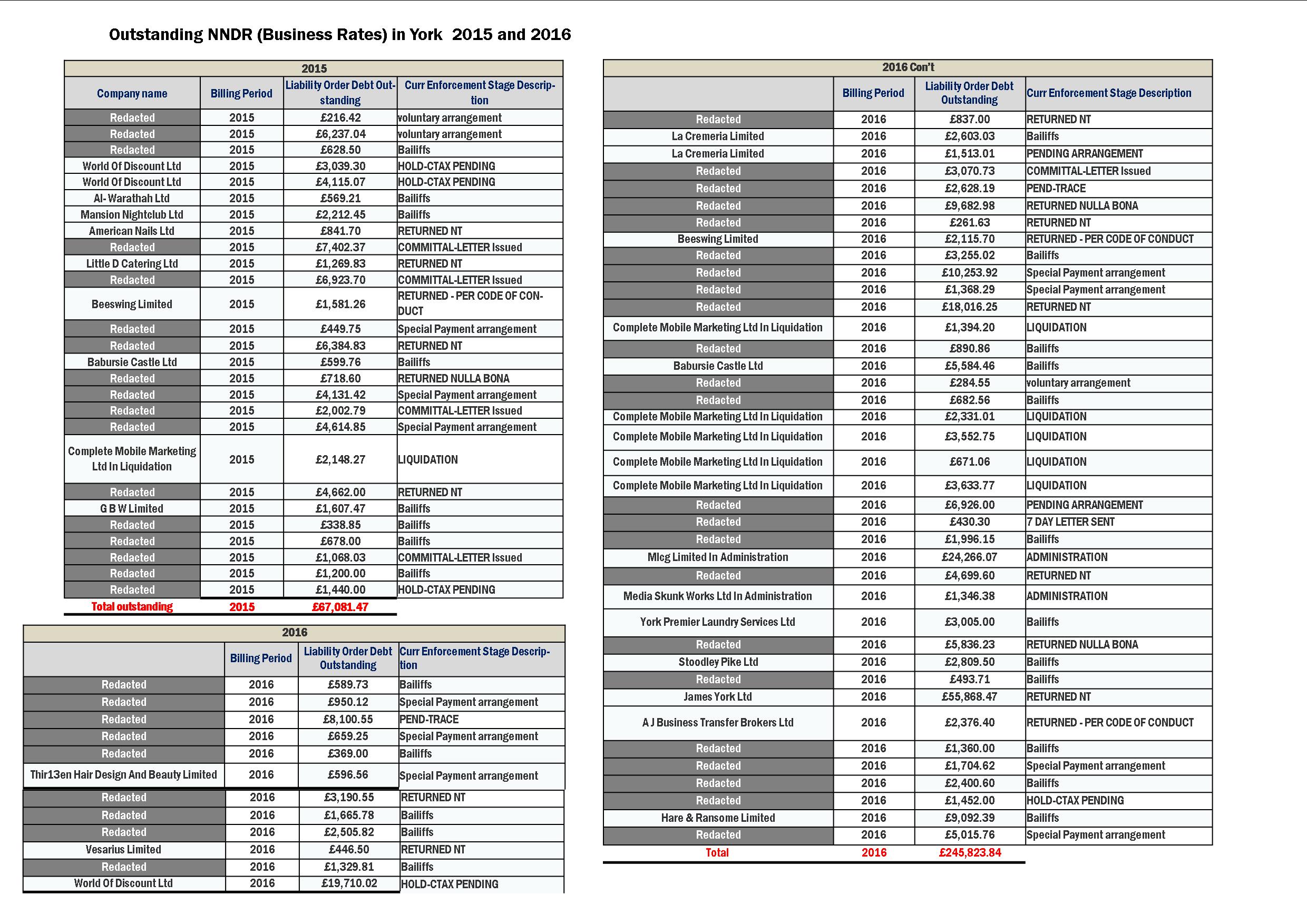

NB. The Council refused recently to publish a complete list of long term business rate debtors.

Let’s start with an example of good practice.

Let’s start with an example of good practice.

Nor can the York Council bask in any glory. In February, we asked which businesses had not paid their NNDR (Rates) bills in each of the last 3 years.

Nor can the York Council bask in any glory. In February, we asked which businesses had not paid their NNDR (Rates) bills in each of the last 3 years.