The City’s £250,000 “Safer Communities Fund” is set to be scrapped.

The crime busting scheme was one of the first initiatives announced by the new LibDem/Green administration in July 2019.

Use of ward budgets for “target hardening” works over the last 2 decades had been a popular choice by local residents.

Stronger fencing, ,CCTV cameras, more robust street furniture, anti climb paint, snicket/alley closures, improved lighting and many other improvements had been funded from this source.

A report last year explained the purpose of the new Fund.

As part of the council’s Supplementary Budget Proposals agreed on

17 July Council, £250k was awarded to wards as a “Safer

Communities Fund”. The allocation of this funding, in proportion to

population in the normal way, is shown in Annex 1.Building on the success of the Community Care fund it is proposed that the Safer Communities Fund is operated in a similar way in that it is added into ward revenue funds so that it can be used flexibly by wards on any projects that meet residents’ priorities in terms of creating safer communities.

It is suggested that the planned impact of the spend should be set out in advance and the subsequent outcomes evaluation (see para 25 below concerning evaluation).

Evaluation could be developed in partnership with the Community Safety Team who would also be able to provide evidence-based examples of good practice so that we are able to encourage community groups to put forward good proposals within a flexible budget regime which is operated in line with policies and procedures for ward funding.

PCSOs could also be consulted as part of the ward team as they will

be able to bring useful views to the table and this will provide an

excellent opportunity to strengthen ties between wards and the police.

While it is fair to say that the new scheme has remained something of a enigma to most residents, concerns about crime levels generally – and anti social behavior in particular – remain a high in several neighbourhoods.

In recent years, the Councils attempt to delegate spending power to local communities has been flawed.

A £1 million ward highways budget was divided between equally highways improvements and walking cycling schemes. The latter was spent almost entirely on projects in the south east part of the City.

A year later it is difficult to identify any roads or paths that have benefited. This may partly be because the Council fails to maintain a list of schemes on its web site with appropriate progress reports.

There is a stronger sense of local community in the wake of the pandemic.

People do want to be involved in decision making.

But the current processes used by the Council fail to fully engage people.

Perhaps the increased use of social media seen during the Lockdowns offers a clue as to how engagement levels can be raised in the future.

In the meantime, the Council must explain how it will improve the level of support that it offers to those policing our streets.

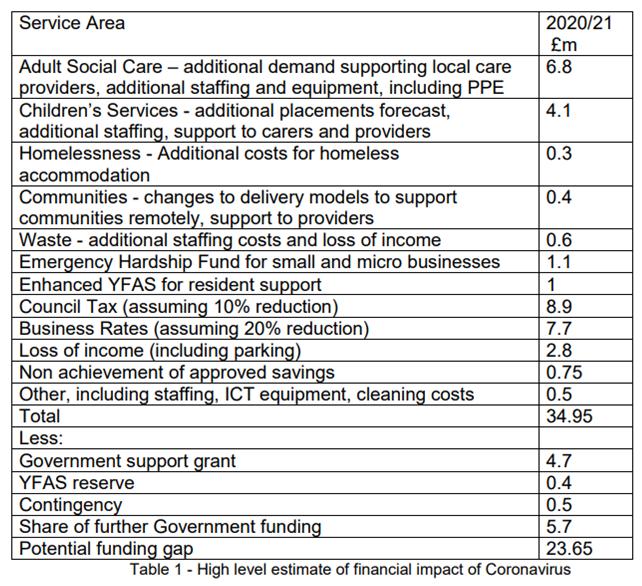

This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.

This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.

Growth

Growth