Budget plans for next year published as residents say highways maintenance is top priority for them

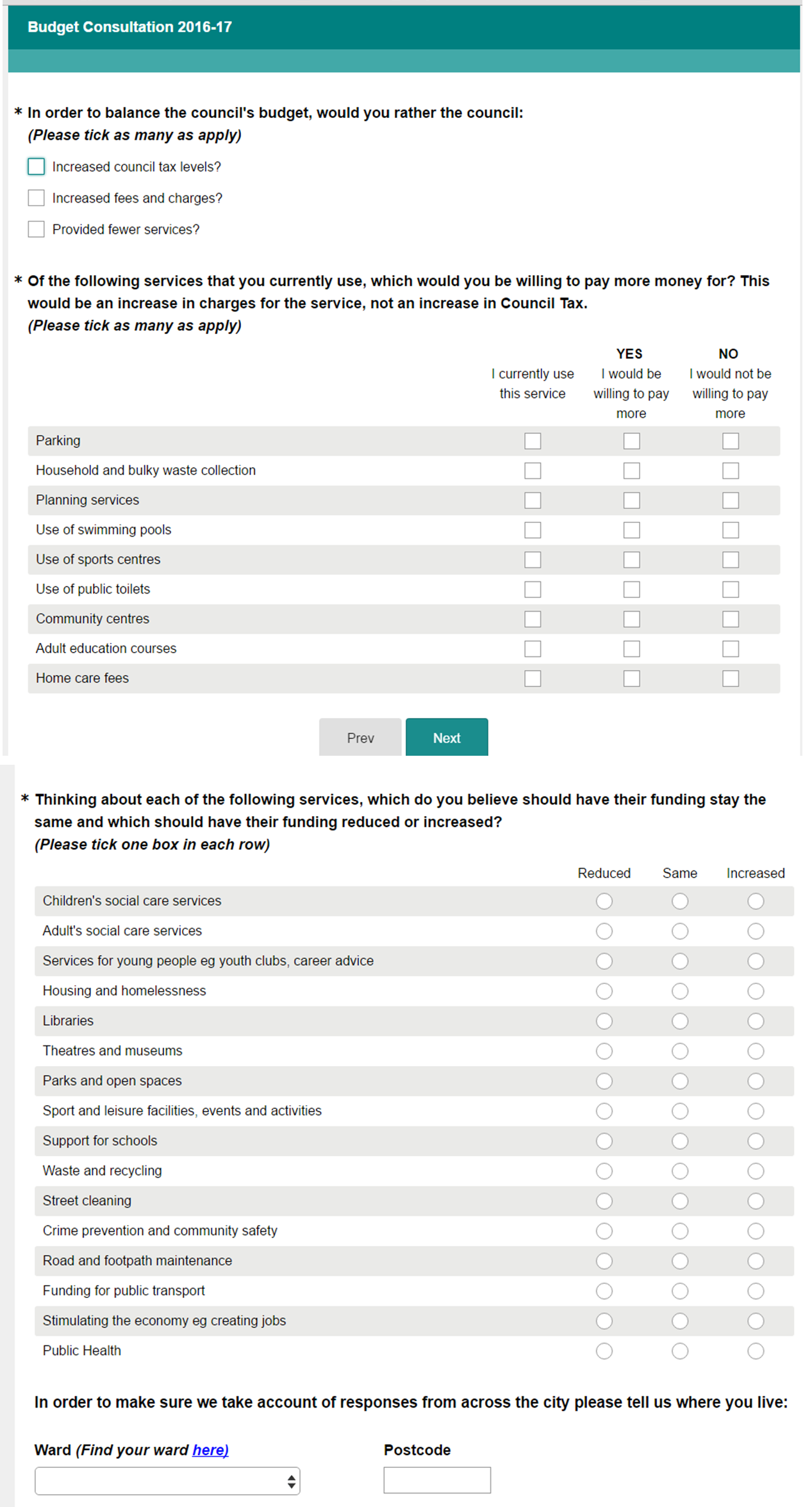

York residents will have a month to comment on the York Councils budget plans for the next financial year.

Plans for some of the key expenditure areas were published over the weekend.

Council Tax will increase by 3.99% with 2% of the increase being earmarked for social care services. The latter will get a £4.5 million boost.

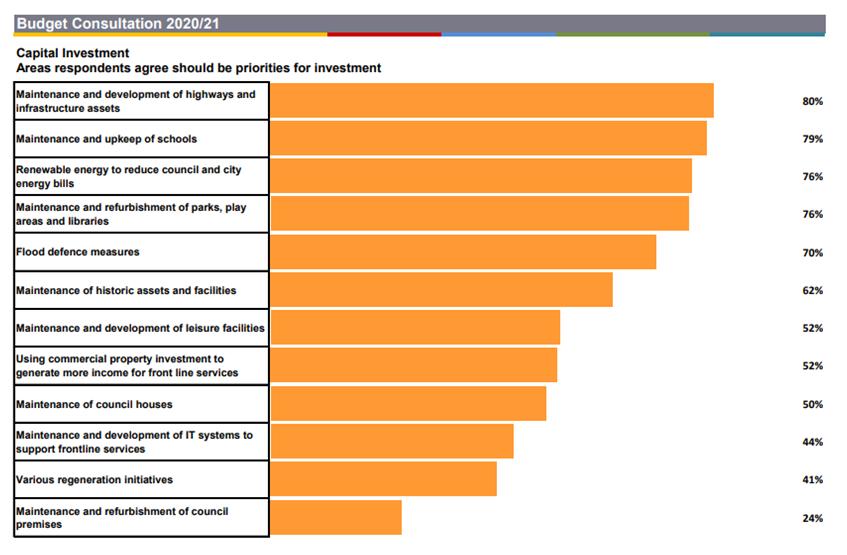

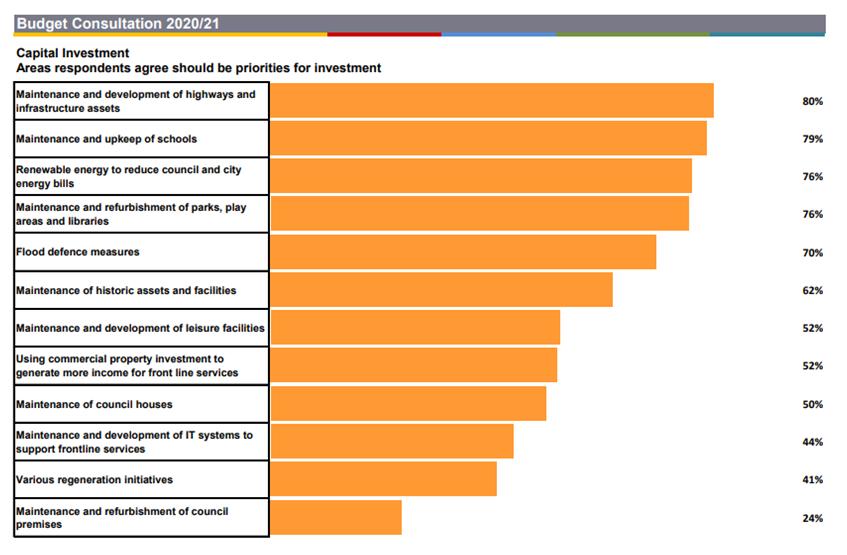

The results of the Councils consultation on budget options are also published. Only 691 residents responded. Their top expenditure priority was, unsurprisingly, road and path repairs.

The Council plans to make £4 million in savings although many of these are, largely opaque, financial management tweaks.

Council staff will get a 2% pay increase.

£11 million will be invested in services as part of the Council budget plans.

- As much as £1 million will be invested in a new waste and street environment services. This is in addition to capital investment of £6 million on new refuse collection vehicles.

- Capital investment of over £12 million will support, repair and improve the highways network. This includes £275,000 for the creation of a reactive pothole repair team,

- A long term investment of £3 million in planting more trees is proposed as part of the “northern forest”

- Borrowing for house building results in a £1.5 million bill for interest charges on money already borrowed although £7 million is also allocated for modernisation works to the Council housing stock

Corporate

Savings include centralising communications budgets, fee increases and “making best use of Council assets”.

Growth includes £141,000 extra for Councillors pay and £80,000 for an “organisational development programme to ensure delivery of key Council priorities”

As well as the welcome commitment to invest more in highways maintenance there are some, surprises in the capital programme . There is £100,000 for a trial of robotics monitoring of social care clients. It will utilise AI. £230,000 is earmarked to replace rising bollards on Bishophill, while a whopping £6.6 million will go on new refuse collection vehicles. This, in effect, confirms that the reason for the multiple vehicle failures last year was poor replacement programming (3 of the new vehicles will be electric powered).

As well as the welcome commitment to invest more in highways maintenance there are some, surprises in the capital programme . There is £100,000 for a trial of robotics monitoring of social care clients. It will utilise AI. £230,000 is earmarked to replace rising bollards on Bishophill, while a whopping £6.6 million will go on new refuse collection vehicles. This, in effect, confirms that the reason for the multiple vehicle failures last year was poor replacement programming (3 of the new vehicles will be electric powered).

29 Castlegate

More is to be spent maintaining and extending the electric car recharging network. £270,000 is to be spent renovating 29 Castlegate which has been empty for several years. The report says “The condition of the building both internally and externally is deteriorating whilst unoccupied” (Quelle Surprise!)

Theatre Royal

The York Theatre Royal will get another £500,000 to spend on heating, lighting and access improvements. (NB. The Theatre received a £770,000 grant 3 years ago to complete refurbishment work & was supposed to be self-supporting by now).

Installing “hostile vehicle” prevention barriers in the City centre will cost £1.6 million.

Health and Adult Social Care.

Savings include changes at Yorkcraft and revised charging arrangements.

Growth mainly reflects price increases from suppliers and increased demands from an ageing population.

Children and Education

Savings include reducing child placement costs & less for community centre maintenance.

Growth items include an extra £250,000 for “safer communities” and £50,000 to create a Mental Health early intervention fund.

Environment and Climate change

Savings: Increases in fees and parking charges including evening charges, Minister badges and an “additional diesel duty” in 2021.

Growth items extra litter /poop scoop bins, better tree maintenance (halleluiah!), “ review of waste collection, including plastics and food waste” and including adding two extra green waste collections each March from 2021 onwards, additional staffing on waste rounds, improved city centre cleaning, effective weed control (praise the Lord!), another study into re/opening Haxby railway station (the fourth in the last 2 decades) and additional Taxi Licensing enforcement .

Growth items extra litter /poop scoop bins, better tree maintenance (halleluiah!), “ review of waste collection, including plastics and food waste” and including adding two extra green waste collections each March from 2021 onwards, additional staffing on waste rounds, improved city centre cleaning, effective weed control (praise the Lord!), another study into re/opening Haxby railway station (the fourth in the last 2 decades) and additional Taxi Licensing enforcement .

Housing

Savings Extended use of smart mobiles, reduced use of sub-contractors, reduced void times plus new James House rents,

Growth Electrical safety check programme, water hygiene testing, quicker repairs & “improving the care of estates”

Capital investments include an average of £8 million a year to be invested in Council house modernisation and building insulation programmes.

NB. The report pointedly does not make any reference to Council House rent levels.

We will publish other details as they become available

Growth

Growth

There are still a large number of defaulters who have yet to pay their Council Tax for last year.

There are still a large number of defaulters who have yet to pay their Council Tax for last year.