But how to pay for a fairer system beats most residents and the media

In 2014 the government forced the York Council to take responsibility for setting up a support scheme for residents who were unable to pay the full amount of Council Tax. The then Labour Controlled Council set the level of support at 70% of the amount due. Around 7000 residents were hit by the change, with some as much as £700 a year worse off.

Many, who were otherwise living on benefits, had an extra £5 a week to find. Many were forced into debt with mounting arrears.

The 70% level was one of the harshest set in the country. Most Councils expected poor residents only to pay between 10% and 20% of their Council Tax bill. The new Council decided to consult on whether the threshold should be raised and, if so, how the loss of income for the Council could be offset.

A survey of residents received only 453 replies (there are 87,000 homes in the City) but a majority (69%) said that a higher level of rebate should be implemented.

Advice agencies in the City are recommending a level of 83% which would mean that the Council would need to find savings – or additional income – of around £487,000 pa to fund the deficit.

That is the equivalent of a Council Tax increase of just over 0.6% for everyone in the City.

Where would the money come from?

The Council has been criticised in the past for not publishing the full results of its consultations. In the summer, a consultation on the devolution proposals disappeared without trace.

This time analysis of responses bordered on overkill

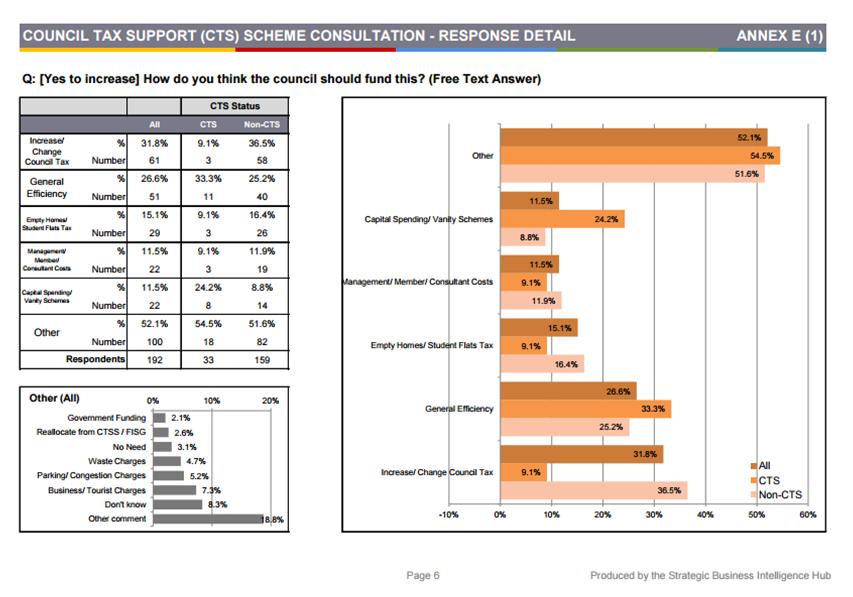

The open ended question about paying for the change has produced a revealing set of reactions from residents. They tend to confirm what most would expect. The average person in the street simply doesn’t know what money raising powers the Council actually has.

Putting up Council Tax.

In so far as there was a majority for any option, around 30% said that they would put up Council Tax to compensate. Yet for over 25 years successive national governments have capped increases in Council Tax. The Chancellor announced a few days ago that Councils would be permitted to increase charges by 2% – but this was specifically to pay for escalating elderly care charges. This is the option apparently favoured by the York Press.

Hit public enemies

These suggestions included new charges which are not legally possible at present. Targets would include a Tourist Tax, student landlord tax, reducing Councillors perks, surcharges on homes worth more than £500,000, 20 mph signs, reduced management salaries and getting rid of the office of Lord Mayor.

Enlightened self interest

In the main these were from respondents who lived in, or near, the City centre. They saw the money coming from increased car parking charges (although the last increase actually resulted in a reduction in Council income), from charging for green bin emptying (many residents in the City centre don’t have garden waste) and various forms of congestion charge (including the introduction of a toll on Lendal Bridge!).

In reality the Council missed a trick by failing to ask residents whether they would pay a 1% increase in Council Tax to offset any change.