Community Stadium not completed, Guildhall business club costs rising

The Council has revealed, in the small print of a report to a meeting taking place this week, that “as part of the council’s response to the COVID_19 pandemic all major procurements are on hold in the short term”. This comes as no surprise with the Castle/Piccadilly development one of these projects now shelved

The Council has expected to recover its investment there using “long term revenue from commercial space”. Speculative building of that sort looks to be that thing of the past for a few years at least.

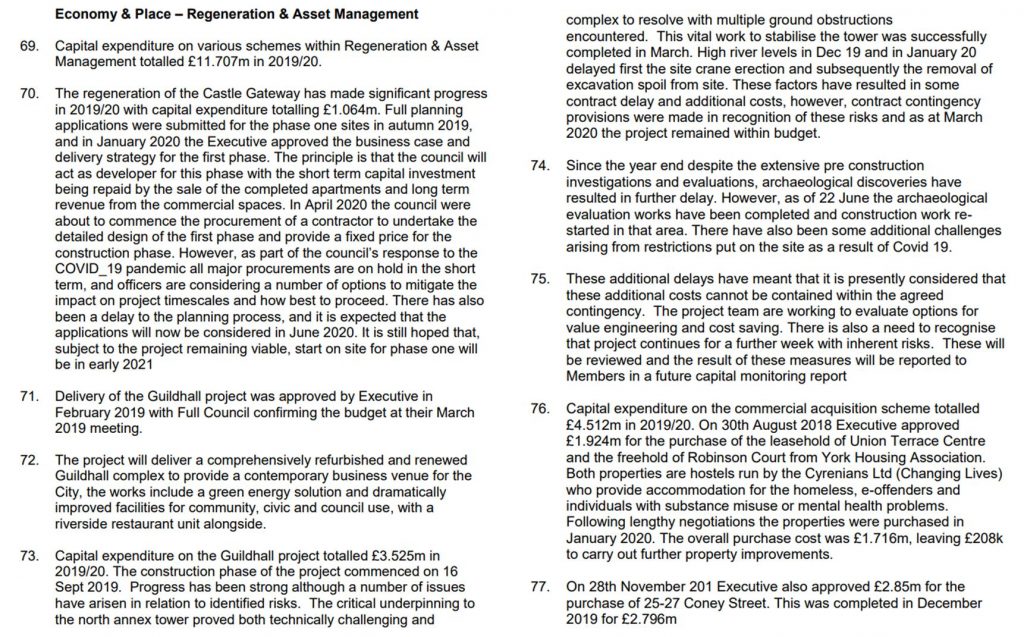

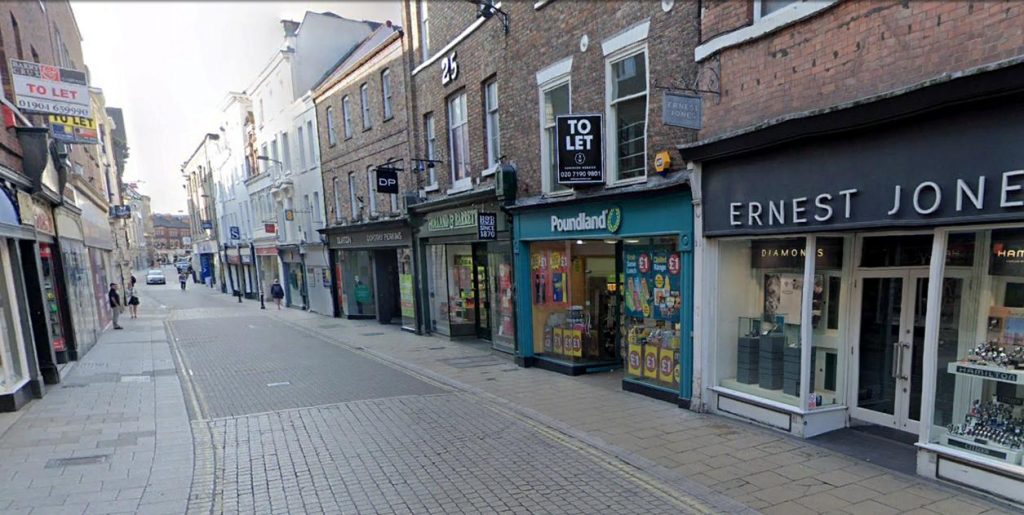

The same report reveals for the first time that, late last year, the Council purchased 25-27 Coney Street for just under £2.85 million This is the block containing the Holland and Barrett store. Just how the rent freeze during the health scare will affect income from this and similar commercial property investments is not explained in the Council report. Generally speaking, in the long run, the City has always benefited from civic investment in land and property ownership. Values in the past have always risen faster than inflation. In the short term, though, such purchases may place additional burdens on taxpayers.

There may be a bigger issue emerging at the Guildhall where delays have caused an escalation in the cost of the £20 million renovation and remodelling project. The report is, however, still claiming that the hugely expensive project will provide “a comprehensively refurbished and renewed Guildhall complex to provide a contemporary business venue for the City, the works include a green energy solution and dramatically improved facilities for community, civic and council use, with a riverside restaurant unit alongside”. Time will tell.

The report confirms that the “Community Stadium” is still a “live building site”. “All certification and testing will only recommence once Government allows the gathering of people to resume, but only at that point. When all contractors and partners are able to return safely to the site to fully complete the works, they will. Only at that point can the Stadium look to hold test events required and open thereafter”. There is no comment in the report about the commercial and community uses planned for the site or the likely timescales for bringing all spaces into use.

Without test events being possible, it now seems unlikely that the football or rugby clubs will be able to play at the stadium from September (the likely start of the National League football season) .

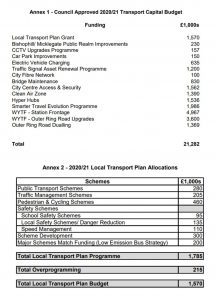

The Councils transport capital programme is being

The Councils transport capital programme is being  This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.

This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.