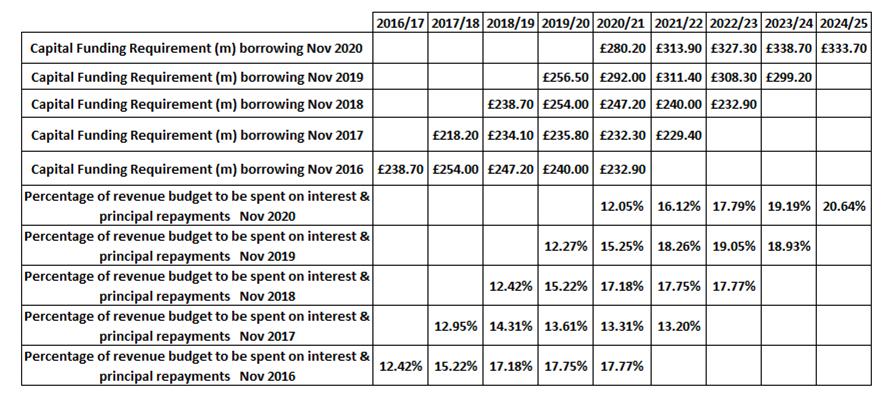

Every November the York Councils Executive Councillors are asked to review its investment and borrowing strategy. A series of, what are termed, “prudential indicators” are published. They offer a guide for taxpayers on how their money is being managed.

Usually the item attracts little interest or comment.

This year may be different with todays national spending review likely to offer a guide on how the billions, currently being borrowed by the government to counter the pandemic, will be repaid.

The York figures do not include provision for the local impact of COVID.

The revenue budget does look set to take a £10 million hit next year with widespread cuts in services inevitable unless the government authorises an above average tax rise. Another option might be to allow Councils to borrow money to prop up day to day spending for a couple of years. This (unlikely) option would have an impact the Councils investment (capital) budget

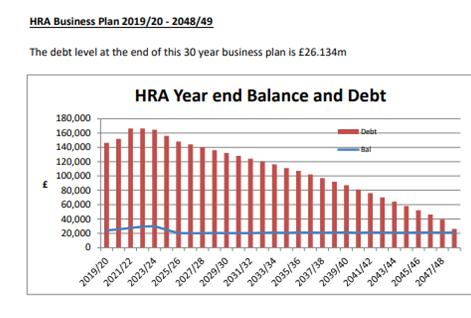

But without that – and isolating the housing revenue account (which is funded from rents) – what is the current liability of York taxpayers?

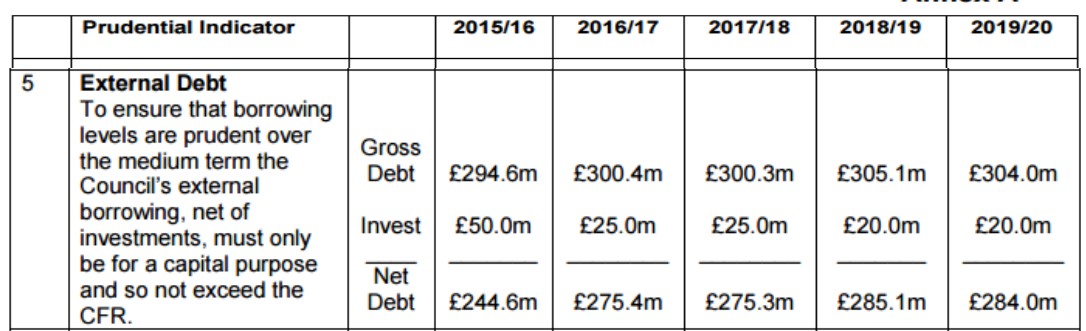

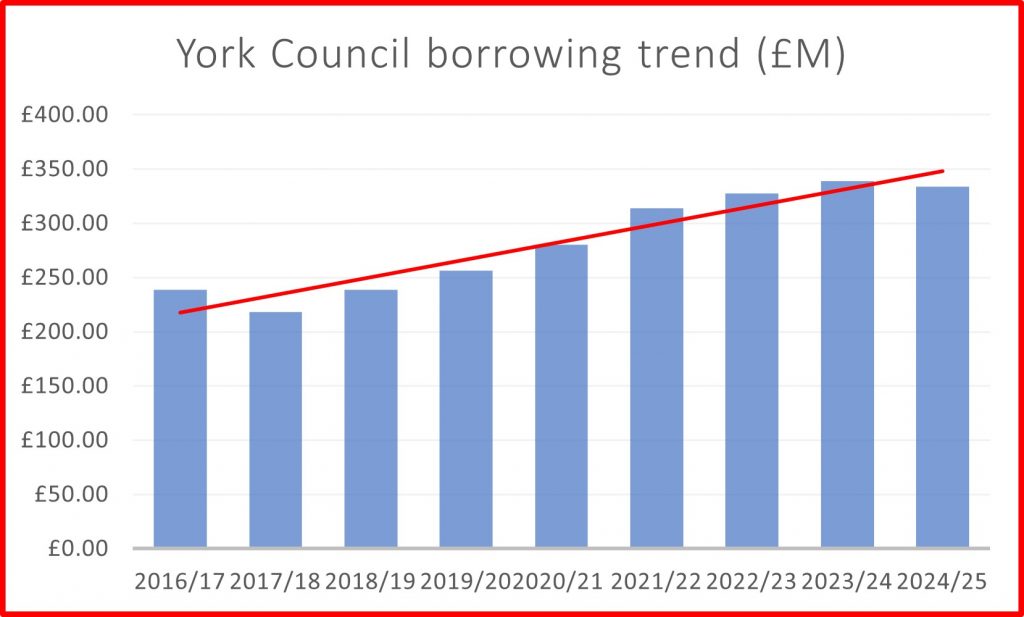

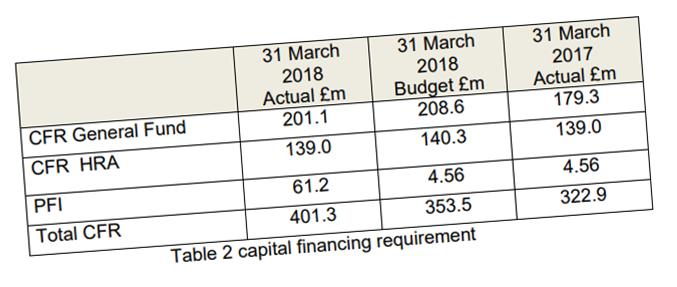

The figures reveal that, from a starting position in 2016 when the authority needed to service £238,7 million of borrowing, by 2023 that liability will have increased to £338.7 million.

That is a 40% increase.

Should we worry?

The short answer is yes. The Council is required to make what is known as a Minimum Revenue Provision (MRP) in its revenue budget to cover principal repayments and interest charges on its borrowing. The proportion has varied over the years but usually around 12% of current account expenditure has gone on servicing debt.

That is set to escalate to 21% by 2024.

That could mean less money being available for core services such as road repairs, caring for the elderly and disabled and keeping the City clean. Many non statutory services such as leisure could be hit hardest.

You can read what the Council says by clicking here

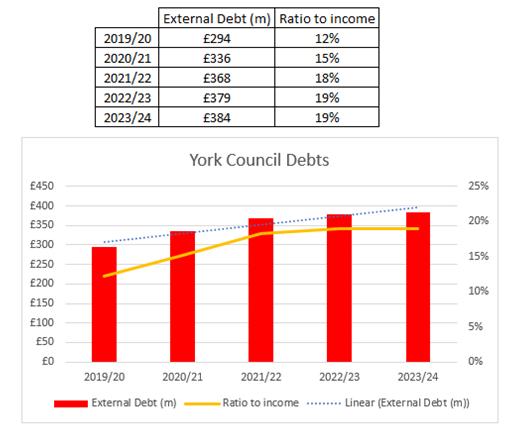

By the end of the year the York Council will have debts of over £318.2 million, up £52 million compared to 12 months earlier.

By the end of the year the York Council will have debts of over £318.2 million, up £52 million compared to 12 months earlier.