D4NT09 Council Tax bill 2013/2014 for property dwelling band F with 25% discount for sole adult resident

The Council has started this week to issue its Council Tax demands for 2017/18. In total council tax will rise by 3.7%.

Residents have the option to spread the cost of their bill over 12 months rather than 10 months by request to council.tax@york.gov.uk

To make it simpler for residents to access a range of council services and report changes for council tax and benefits, they can create their own online account at: www.york.gov.uk/myaccount

At a click of a button they can also pay their council tax online, let the council know if they’re moving house, are claiming sole occupancy discount and student discount.

They can also request a copy of their bill, set up a payment plan if they’re in arrears and set up a Direct Debit.

In addition to this, council tax bills can also be sent by email. It’s free, fast, environmentally friendly and secure. Anyone without internet access can continue to call the customer service centre or visit staff at West Offices.

Included in the council tax information are details about financial support from the December 2015 floods. The council has been helping residents whose homes were affected with government payments and council tax exemptions. The deadline for claiming this financial support, if they haven’t already done so, is before 31 May 2017 by request to council.tax@york.gov.uk

The council’s gross expenditure for 2017/18 is £376.006m (380.391m in 2016/17) the amount raised though council tax in 2017/18 will be £81.630m (£77.072m in 2016/17) plus £703k (£667k in 2016/17) from parishes.

For more information about council tax visit www.york.gov.uk/counciltax

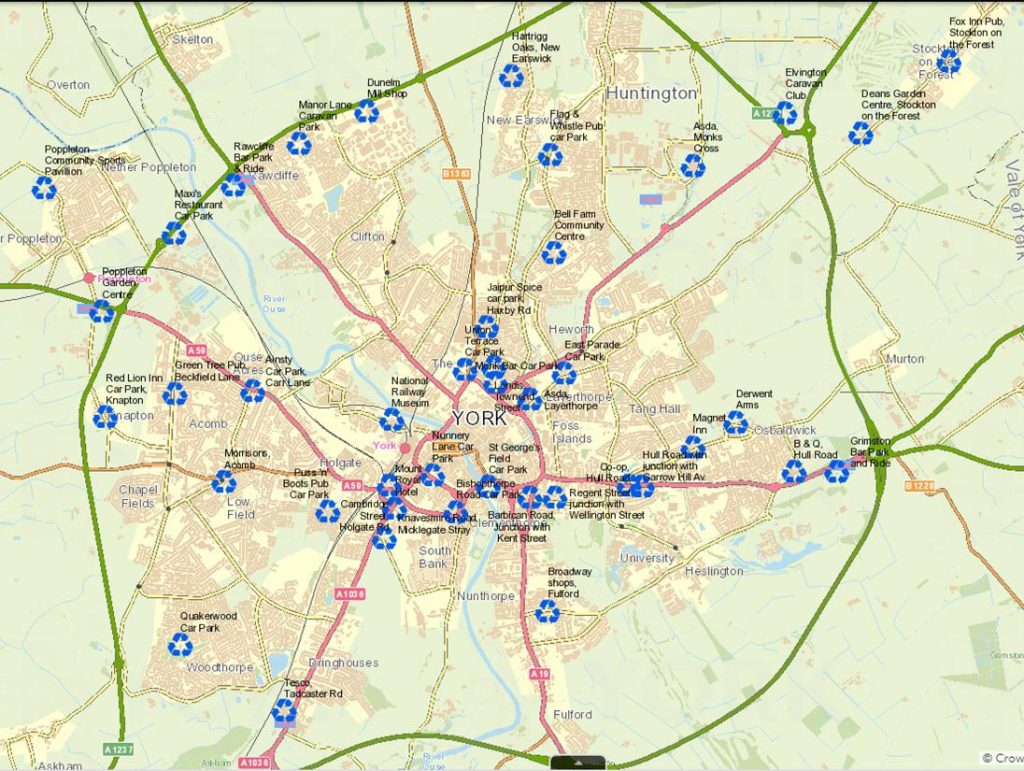

City of York Council has “got Christmas all wrapped up and we’ve pulled our festive information into one place to help residents plan ahead”.

City of York Council has “got Christmas all wrapped up and we’ve pulled our festive information into one place to help residents plan ahead”.

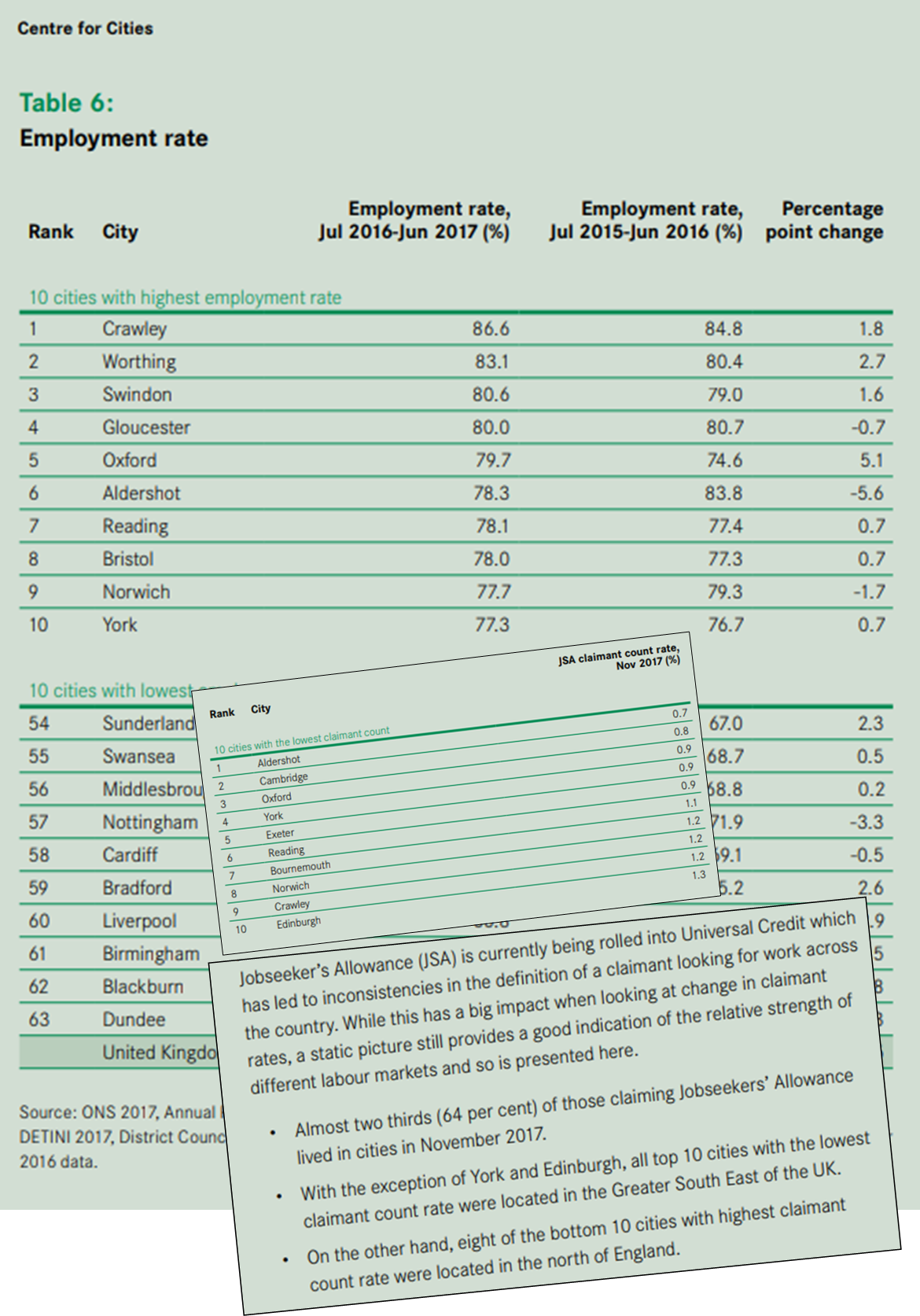

Ahead of Universal Credit rolling out for even more residents in York from 12 July, the council says it will support residents who need digital assistance and budgeting support with Universal Credit.

Ahead of Universal Credit rolling out for even more residents in York from 12 July, the council says it will support residents who need digital assistance and budgeting support with Universal Credit.