Ahead of Universal Credit rolling out for even more residents in York from 12 July, the council says it will support residents who need digital assistance and budgeting support with Universal Credit.

Ahead of Universal Credit rolling out for even more residents in York from 12 July, the council says it will support residents who need digital assistance and budgeting support with Universal Credit.

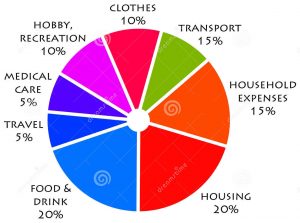

Universal Credit is a new benefit, handled by the Department for Work and Pensions, which helps people on a low income or not in work, meet their living costs. It combines six benefits, including housing benefit and working tax credit, into a single monthly payment.

Currently Universal Credit is only available to single jobseekers in York but from 12th July parents and couples, including people who can’t work because of their health, living in the city and making a new claim will also receive it.

Universal Credit is one of the biggest ever changes to the benefit system and this may cause people to be worried about what will happen to their benefits. People who need assisted digital support or personal budget support should contact the council’s benefits service on 551556 or to visit www.york.gov.uk.”

There are several changes to previous benefits with Universal Credit, including:

- · payments are made in arrears once at the end of the month, rather than being paid every week.

- · payments will go straight into a claimant’s bank account. This means people may need to set up their own direct debits for expenses like rent if it was paid directly to their landlord under the old Housing Benefit system.

Residents who want to claim Universal Credit who are unable to use the internet or don’t understand how to make the claim can contact the council on 01904 551556 to ask for help through Assisted Digital Support (ADS).

People who would like to claim Universal Credit but are having trouble opening a bank account or managing their money can contact the council on 01904 552044 to ask for help through Personal Budgeting and Support (PBS). PBS can help with budgeting and advice on finding a bank account as Universal Credit cannot be paid into a Post Office card account.

The council has also teamed up with South Yorkshire Credit Union Ltd to give tailored advice which could include consolidating any repayments into a single, more manageable account at a lower, fixed interest rate, rather than resort to unregulated lenders or loan sharks.

Private or council tenants or mortgage holders are welcome to take advantage of the scheme which aims to help people budget and manage any debts.

For more information about the rollout of Universal Credit in York visit www.york.gov.uk

York residents can take control of their money for free ahead of changes to benefit payments in the summer, thanks to City of York Council teaming up with South Yorkshire Credit Union Ltd.

York residents can take control of their money for free ahead of changes to benefit payments in the summer, thanks to City of York Council teaming up with South Yorkshire Credit Union Ltd.