Lincoln Court

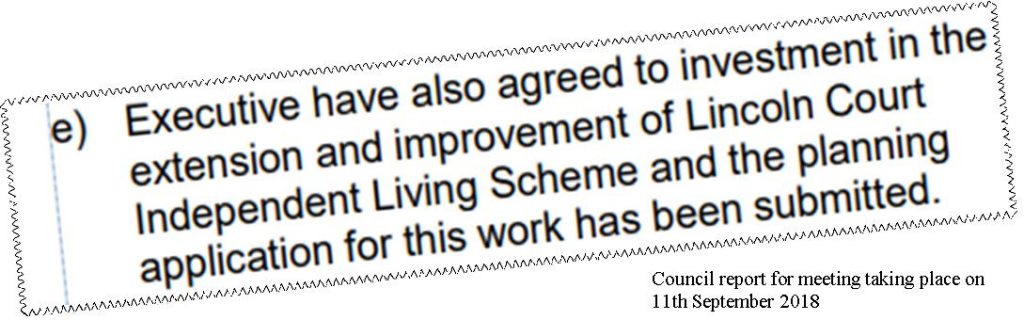

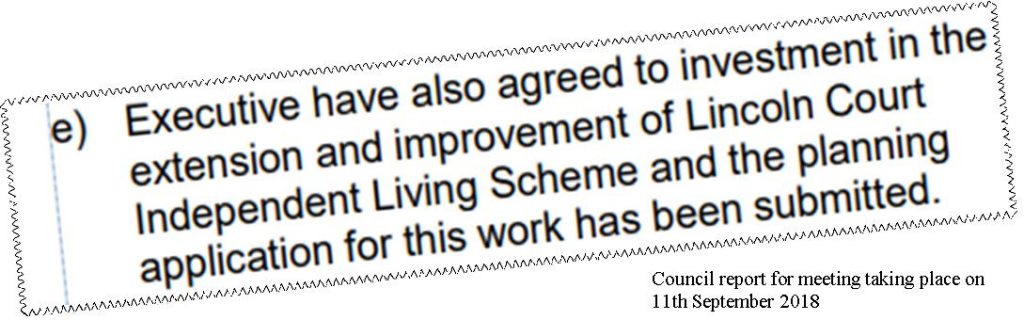

In a report to a meeting taking place next week, officials are claiming that a planning application for the upgrade of the Lincoln Court independent living home on Ascot Way, “has been submitted”.

This will come as news to the residents living in the building who are eagerly awaiting details of the final design for the modernised site and the construction timetable.

There is no such application displayed on the Councils “planning portal“

So far only the demolition of the adjacent Windsor House building and subsequent construction of a centre for disabled children has reached the planning application stage. That application was submitted on 29th June.

It is a matter of some concern as residents will want to see an integrated timetable for both developments which ensures that work on the whole of the site is completed quickly.

They will also want to see the Newbury Avenue development completed before work starts on Ascot Way.

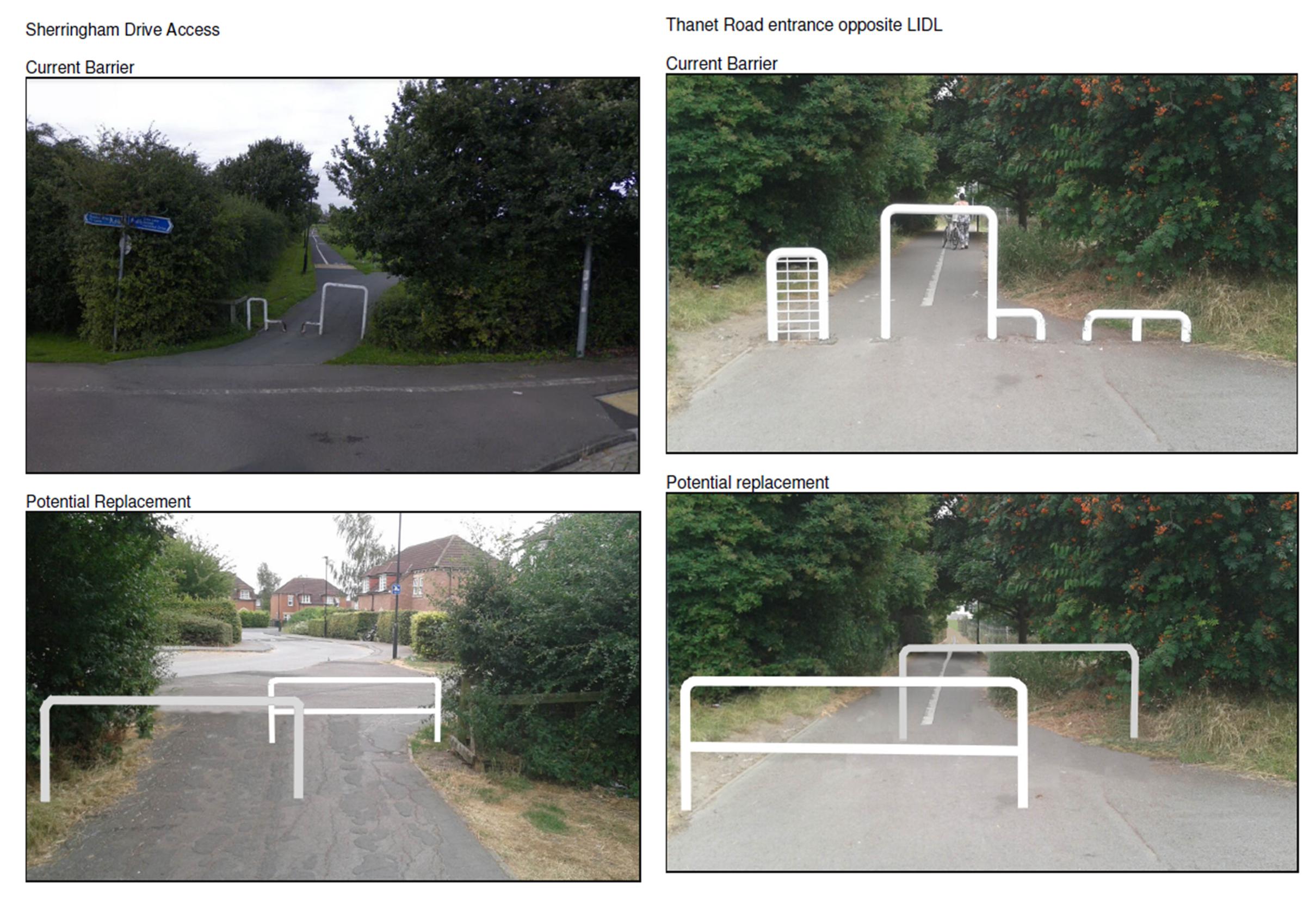

Both developments will put considerable pressure on parts of Kingsway West which offers the only access route into the area.

Kingsway West is a cul de sac and already suffers from congestion caused by poor parking provision on the area near the Ascot Way junction.

The Liberal Democrats have published a comprehensive blueprint for replacing the broken business rates system, cutting taxes for businesses by 5% in

The Liberal Democrats have published a comprehensive blueprint for replacing the broken business rates system, cutting taxes for businesses by 5% in