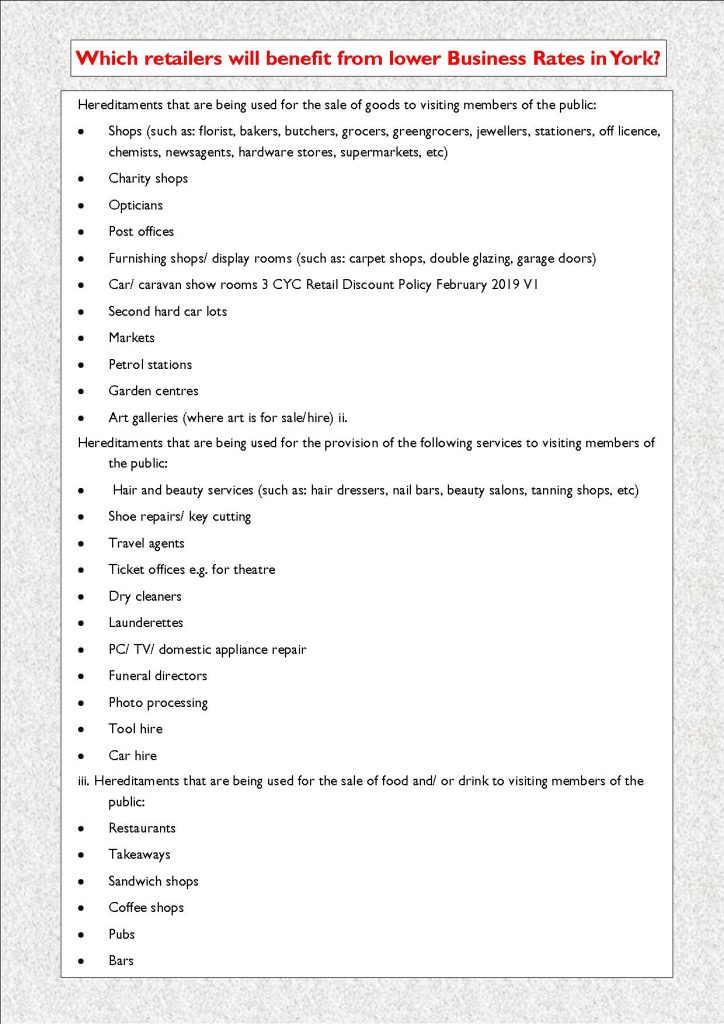

Retail businesses qualifying for rates relief

The Council has announced how it proposes to implement the governments rates reduction scheme for retailers.

In order to help the beleaguered High Street, retailers will get a 1/3 reduction in business rates.

Small businesses with Rateable Values of under £12,000 don’t pay business rates anyway. Now those with Rateable Values of up to £51,000 will get more help.

The purpose of this new discount is to support the ‘high street’ which has been affected by changes in consumer spending preferences such as online shopping. The relief is temporary for two years from April 2019.

A report to a meeting next week says, “The purpose of this new discount is to support the ‘high street’ which has been affected by changes in consumer spending preferences such as online shopping. The relief is temporary for two years from April 2019”.

There are some notable exclusions from the scheme. These include professional services, cinemas, theatres, museums, night clubs and music venues.

Some eyebrows will be raised that restaurants and bars operating in the profitable hospitality economy in the City centre may qualify for discounts.

The Council will implement an “appeals” process for any businesses that feel aggrieved with their categorisation.

The scheme does little to address the underlying problem of low-cost on-line retailers who many think provide unfair competition.