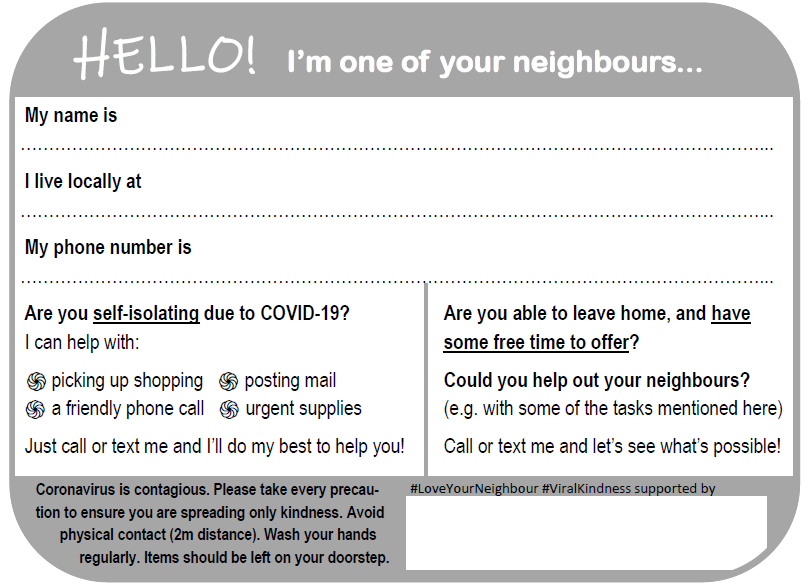

City of York Council is inviting residents to have their say on changes to its Council Tax Support Scheme.

Any change would remedy the unfairness of the last Labour Council which imposed a system which hit hardest the lowest paid members of society. They were told to pay several hundreds of pounds which many simply didn’t have. Labour had hoped that the government would be blamed for the cynical ploy. Instead electors kicked out the Labour leadership at May’s Council poll.

The consultation takes place from: Monday 2 to Sunday 29 November 2015 and asks whether the council should consider providing more assistance to residents by increasing the maximum 70 per cent discount they can receive.

click

To complete the consultation visit www.york.gov.uk/consultation . Drop-in sessions are also taking place on:

•Wednesday 4 November West Offices, Station Rise, 2.30 – 7.30pm

• Thursday 12 November Burton Stone Community Centre 2.30 – 7.30pm

• Monday 16 November Haxby Explore 2.30 – 7.00pm

• Tuesday 17 November Acomb Explore 2.30 – 7.30pm

• Monday 23 November Tang Hall Explore 2.30 –7.30pm

• Tuesday 24 November Copmanthorpe Library 2.30–6.30pm

• Thursday 26 November Fulford Explore 2.30 – 5pm

A review of the York Council Tax Support (CTS) scheme was taken to Executive on Thursday 29 November, which saw members agree to progress with a consultation.

At the meeting, Executive were presented with a report which outlined what existing financial support was available to residents, the number of people seeking support and what further steps could be taken to support York’s most financially vulnerable residents in the short term but also in a sustainable way going forward.

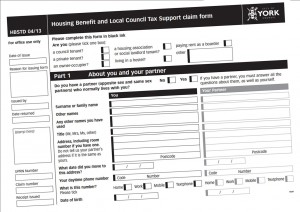

City of York Council’s CTS scheme has been in place since April 2013 and is intended to provide low income and vulnerable council tax payers with financial help towards meeting their council tax liability.

Since April 2013, the maximum amount of Council Tax support or discount available to working age households in York is 70 per cent, which means every working age household is required to pay at least 30 per cent of their council tax bill regardless of their income or family circumstances.

The council is now considering whether to change the current 30 per cent cap and is asking residents to have their say, which could result in changes being implemented as soon as next year subject to Full Council approval.

Currently there are 5,096 working age residents who qualify for CTS – who are typically reliant on welfare benefits for their income because of illness, disability or unemployment, receive tax credits, are lone parents or who are in low paid work.

Residents who are state pension age and qualify on the basis of their income will continue to have support based on 100 per cent of their Council Tax liability and are not affected by this consultation.

Full details of the scheme can be found on the council’s website. www.york.gov.uk/counciltaxsupport

The council’s YFAS (Financial Assistance) scheme was only introduced in 2013 (the same time as CTS) and provides emergency financial support in a crisis but also support for qualifying residents with their council tax. This was initially grant funded by the Department of Work and Pensions, which then withdrew funding from April 2015.

The council has continued to commit a base budget of over £500k to the scheme, with additional funding for two years, to ensure the impact of withdrawal of the specific grant was not felt by YFAS residents.

(more…)