One of the reports least likely to be subject to detailed scrutiny, as the York Council prepares its budget for next year, is the upward trend in interest charge commitments

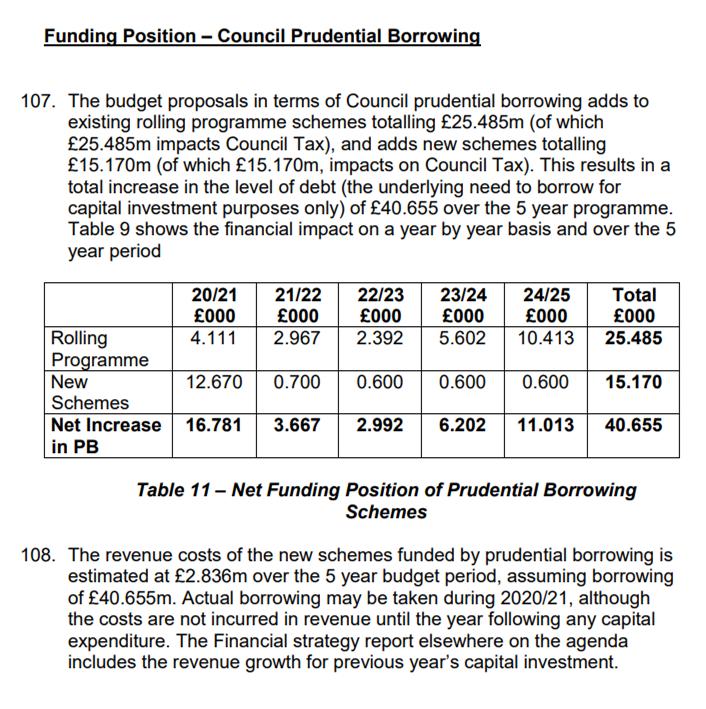

By 2022, the amount borrowed by the Council is set to escalate to over £178 million a year. Total debt will reach over £1/2 billion the following year.

This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.

This is by far the largest liability the Council has had since it became a unitary authority over 20 years ago.

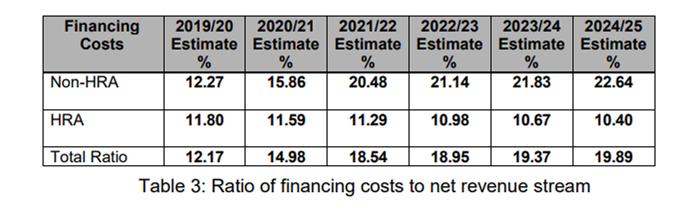

With interest rates on borrowing by Councils now standing at around 3.5%, it means that, within the next 5 years, the proportion of the Council Tax collected in the City, and used to service debt charges, will increase for 12% this year to 23%. That figure assumes that there will be no increase in interest rates.

In practice the trend means that there will be less money available to spend on street level public services.

So, should we be worried?

At one level, no.

The forecast expenditure, although much closer to the legal borrowing limit, will still be within the ceiling in 2024.

But there is more to it than that.

It is not just principal and interest repayments which erode the flexibility available on the Councils revenue account. New services often bring additional running costs. The Council has forecast zero net expenditure on some high risk investments (e.g. the commercial office space at the Community Stadium, the “business club” being set up at the Guildhall and the Castle Mills development). If it got any of these decision wrong, then taxpayers face a big hit.

What is the additional investment big spent on.

A list of new items being considered tomorrow (Thursday) can be found by clicking here. There are dozens of other items which have already been agreed.

So, is that the extent of the risk?

Unfortunately no. There are several investments that the Council wants to make but for which it has not yet made full financial provision. By far the largest is the York Central project. This could add tens of millions to the programme depending on what financial backing central government decides to offer.

The dualling of the northern by pass is also still not fully funded. Such plans as have been published omit, for example, flyovers at key junctions and across the river. Both could add tens of millions to the costs.

Could we make savings?

29 Castlegate – £1/4 million repair bill

Certainly. The Council has taken on the risk at several developments which the private sector considers to be nonviable. This started when the Council underwrote the office development at Monks Cross, a similar logic was applied to the £20 million Guildhall scheme and most recently we saw the £44 million Castle Piccadilly project brought “in house”. A similar decision was taken on the housing development at Lowfields.

This year £270,000 will be spent on repairing and remodelling 29 Castlegate – an obvious project on which to seek a commercial partner.

Successive generations will end up paying the additional annual £2.8 million interest charges on this year’s new project list unless a more prudent approach is adopted by Councillors.