Lowfields Green – “pack em in” approach to housing development?

Not content with being the largest provider of affordable (Council House) accommodation in the City, the York Council is now considering entering the private rented market.

Under plans to be discussed next week, it would set up a company that would develop homes on land currently owned by the authority. They hope to reinvest the profits from rents, and some house sales, into further developments.

In recent times, Council land has generally been developed by Housing Associations who have rented the properties at little more than the rents charged to Council tenants.

This approach is set to change with the Council now saying it will enter the private rental market.

Private rents in the City are typically three times higher than Council house rents. Private rent levels in the city have increased by 17% during the last 5 years.

Any private rented properties managed by the Council would not be subject to “Right to Buy” legislation (and hence discounts).

Individual developments would still have to include a planning requirement for at least 20% affordable units. It is possible that the housing revenue account (mainly income from Council House rents) will be used to purchase homes to expand further the number of affordable units available.

The sites that the Council hopes to develop through a new QUANGO are located at these sites:

- Former Askham Bar Park and Ride

- Former Burnholme College

- Castle Piccadilly,

- “City Centre car parks”,

- Former Clifton Without School,

- Hospital Fields Road/Ordnance Lane,

- Former Lowfield School,

- Former Manor School,

- Tang Hall Library,

- Woolnough House.

The plan to develop land in the city centre, which is currently used for car parking, may come as a shock. The Council has yet to confirm what its long term policy is on parking space numbers in the city centre, but any reduction is likely to be opposed by beleaguered traders. It is possible that the intention is to add one or two floors above existing car parks. That is an idea that has been floated in the past with mixed reactions.

The inclusion of the other sites may be premature. Particularly so in the case of Lowfields, where a recently submitted planning application has yet to been determined.

Taxpayers face an early blow if the plan is approved.

Investment/return profile

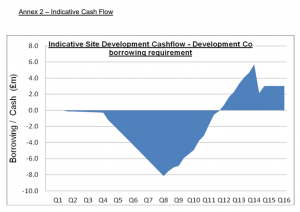

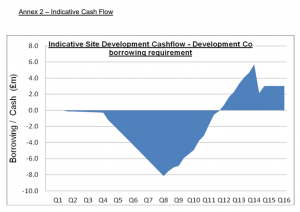

Upfront costs of £450,000 have been identified. This will mostly be spent on staff.

Ongoing staffing costs of £225,000 a year in the development company are predicted, while forecasts suggest that development costs will not be fully offset by sales income for up to 8 years.

All in all, this is a risky and complex project for the Council to be considering. There will be unease that it is biting off more than it can chew with delays on providing homes the most likely consequence.

- In the last couple of years the numbers of new homes built in York has exceeded 1000 – well above draft Local Plan requirements.