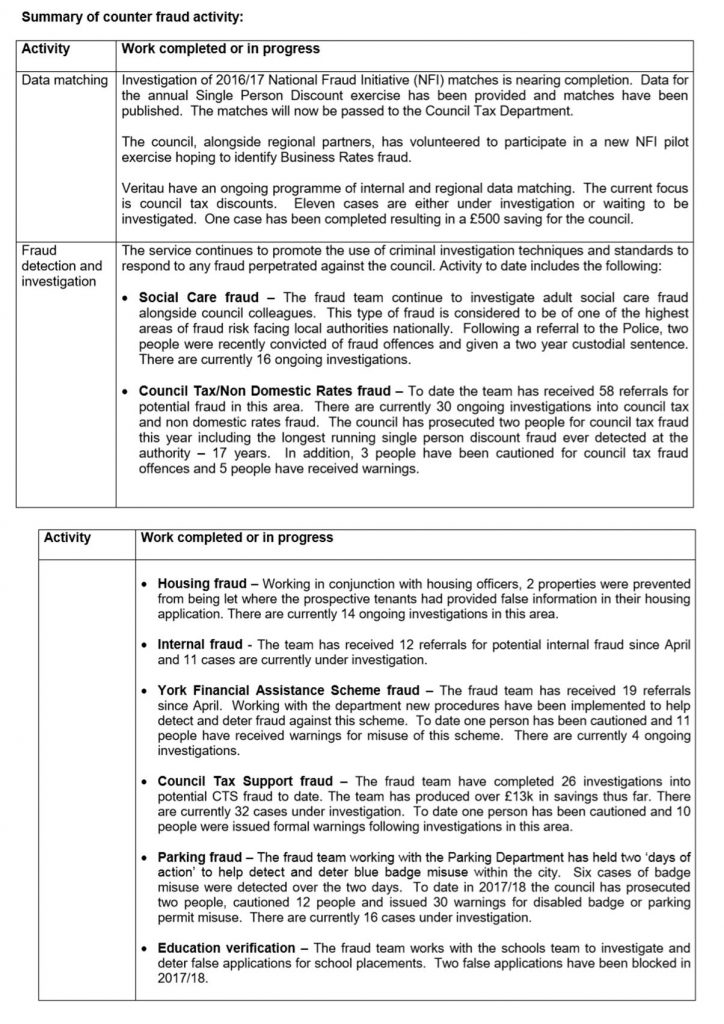

The Councils auditors are cracking down on Council Tax discounts with 11 cases currently under investigation following a “data matching exercise”. These concern bogus “single person discount” claims.

The Councils auditors are cracking down on Council Tax discounts with 11 cases currently under investigation following a “data matching exercise”. These concern bogus “single person discount” claims.

A report reveals that the auditors had received 58 referrals for potential Council Tax/Non Domestic Rates fraud.

“There are currently 30 ongoing investigations into Council Tax and non domestic rates fraud.

The council has prosecuted two people for council tax fraud this year including the longest running single person discount fraud ever detected at the authority – 17 years.

In addition, 3 people have been cautioned for council tax fraud offences and 5 people have received warnings”.

The fraud team have completed 26 investigations into potential Council Tax Support fraud to date. The team has produced over £13k in savings thus far. There are currently 32 cases under investigation. To date one person has been cautioned and 10 people were issued formal warnings following investigations in this area.

Other areas of concern are

- social care where there are 16 investigations in progress.

- 14 cases of housing fraud – making false claims to secure accommodation – are underway.

- The financial assistance scheme where 19 cases are being investigated

- Parking and blue badge misuse. In 2017/18 the council prosecuted two people, cautioned 12 people and issued 30 warnings for disabled badge or parking permit misuse

- Education – making false statements to gain entry to a school – 2 cases.

The report will be discussed at a meeting taking place on Wednesday