The government introduced a maximum level of benefit which can be claimed. The Benefit Cap will only affects residents getting Housing Benefit or Universal Credit. If the cap affects you, your Housing Benefit or Universal Credit is reduced.

You can use the benefit cap calculator on GOV.UK to find out how the benefit cap affects you.

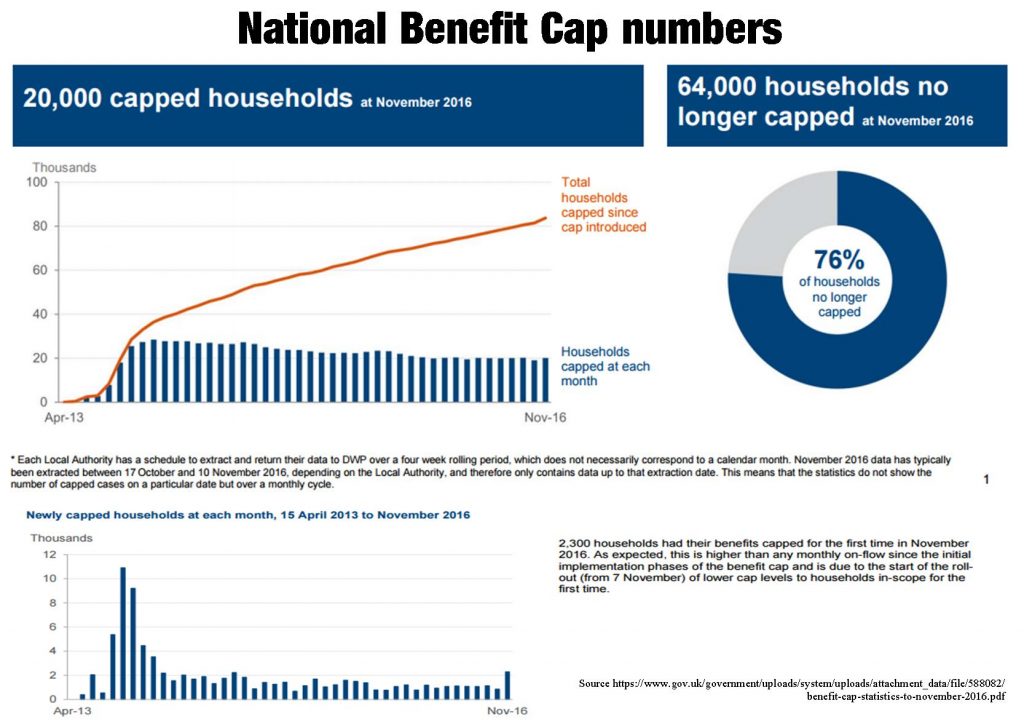

From 7 November 2016, different rates for the Benefit Cap – one for Greater London and one for the rest of the country – were introduced.

For anyone getting Housing Benefit, outside Greater London, the cap is:

- £384.62 a week for a couple – with or without dependent children

- £384.62 a week for a lone parent with dependent children

- £257.69 a week for a single person without children

Some people are exempt from the cap. These include anyone getting Working Tax Credits, Disability Living Allowance, Personal Independence Payment or if they have reached the age of entitlement for getting Pension Credit.

In York 92 claimants have been affected by the cap. The average reduction has been £51.21 per week.

However, figures published by the York Council this week reveal that 5 households have suffered a reduction of over £100 a week

No report on the consequences of the change has yet been considered by the York Council.