In a report to the Councils executive this week, officials report an increase in the debts of the Council.

It was not unexpected.

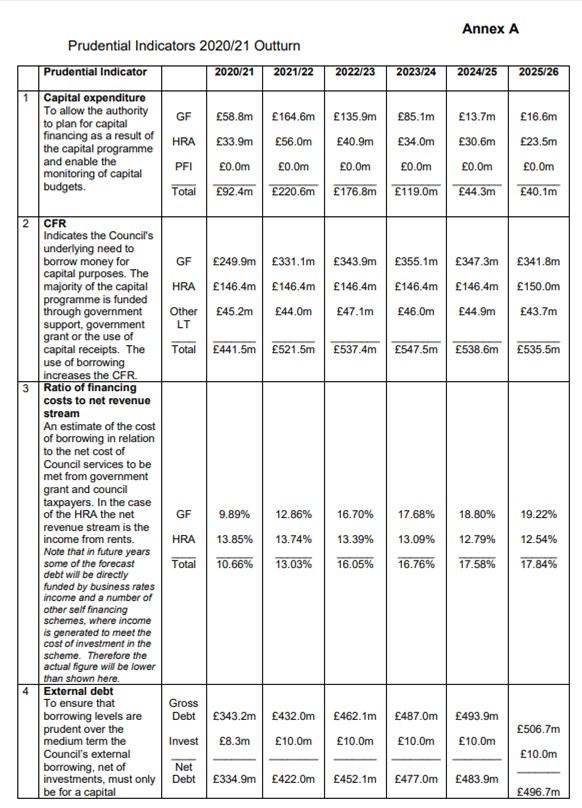

The report reveals that the general fund debt increased from £110.1 million to £151.6 million last year.

£51.5 million in new loans were taken out with only £10 million paid off. Some of the new loans will attract interest payments for 20 years at rates of around 2%.

The Council’s average investment balance has fallen from £48.7m to £15.7 million.

By the end of the 2023/24 financial year, the borrowing requirement is expected to hit £355 million. Around 19% of the York Council taxpayer’s annual bill will then be used to service this borrowing (i.e. pay interest and redemption charges)

We doubt that the report will get much attention from either the Councils Executive or the responsible scrutiny committee. “Live now, pay later” has become a way of life for many local authorities.

York has at least avoided some of the catastrophic investment strategies seen in other places (failed local power companies, incautious property speculation etc).

York has, however, set up several arms length organisations including its own housing development company – reports on which have been thin on the ground recently. Against the background of a very buoyant housing market, that may not be a matter of immediate concern.

Longer term, who knows?