The York Council leadership has written to the government asking for restrictions on borrowing to be eased.

The request comes in the wake of claims that the City faces a £24 million black hole in its finances. The Council was urged last week to provide more details of the deficit but has so far failed to do so.

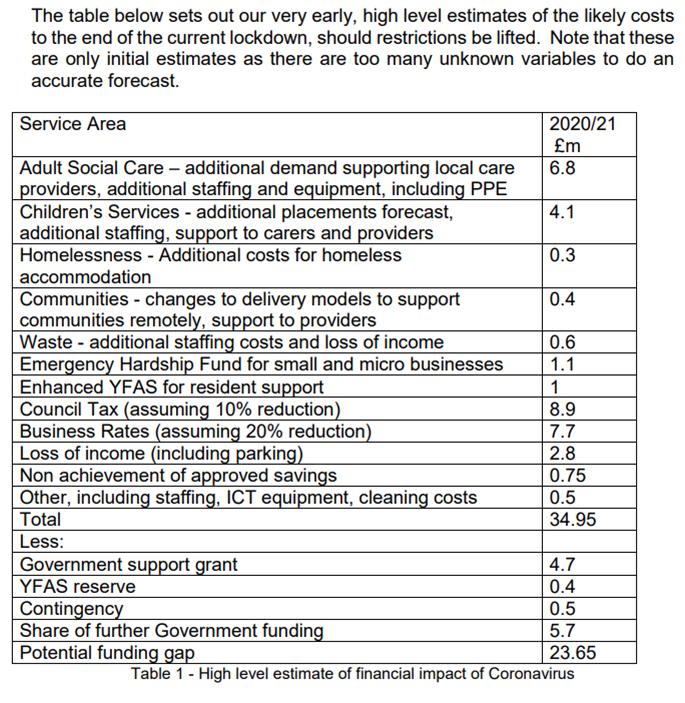

The only information available to the public was published prior to the last executive committee meeting at the beginning of May. This showed that much of the deficit as made up of Council Tax and Rates income defaults although £10.9million was the assumed cost of extra social care.

No savings for reduced travel, energy and materials costs were included.

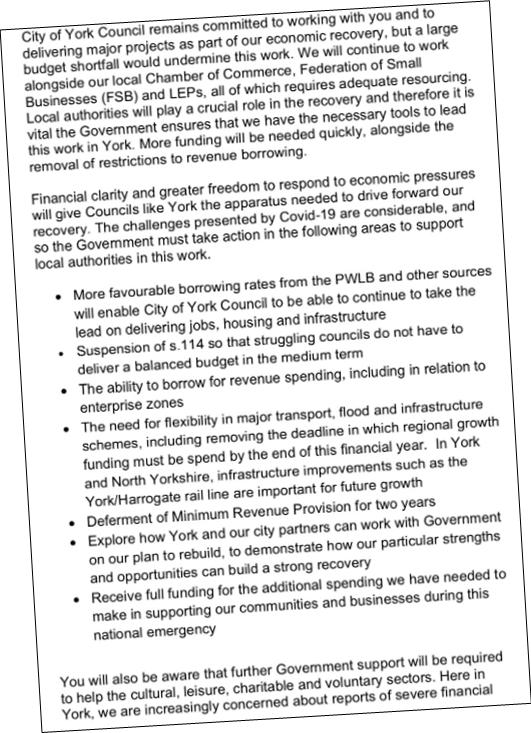

Now Council Leader Keith Aspden has written to Local Government Minister Robert Jenrick making a case for government support.

Perhaps surprisingly the letter concentrates on the Councils borrowing powers. The present Council leadership committed to a £560 million investment programme only a few weeks ago and is now agonising about how much it can actually deliver in the new financial climate.

It has separately said that it will press on with the York Central development although many will feel that some of the basic assumptions about office and retail growth are now redundant. It seems the best – most fanciful – hope is that the government will agree to move the House of Lords to the site.

The Council leadership also says that it wants a 2 year moratorium on making a “minimum revenue provision” in its budget. This is the funding set aside to repay interest and principal repayments on borrowing. The implication of not paying off this debt (most is borrowed over a 20 year period) could be to push a bow wave of debt onto future generations.

This tactical approach is also exposed by another request in the letter.

The Council wants to borrow to cover revenue expenditure – a bit like taking out a bank loan to buy a jar of jam.

The Council goes on to ask for the suspension of S114 “so that struggling Councils don’t have to deliver a balanced budget in the medium term”.

Section 114 of the Local Government Finance Act 1988 requires the Chief Finance Officer, in consultation with the council’s monitoring officer, to report to all the authority’s members if there is, or is likely to be, an unbalanced budget. In practice, this is most likely to be required in a situation in which reserves have become depleted and it is forecast that the council will not have the resources to meet its expenditure in a particular financial year. A full council meeting must then take place within 21 days to consider the notice. In the meantime, no new agreements involving spending can be entered into.

Many will feel that issues like these do require full and public debate. That will involve ensuring that all Councillors and taxpayers are alerted to [problems at the earliest opportunity.

The Council could make a start by providing a candid and full disclosure of its financial position.

It should then go on to review its financial strategy and options in a way that promotes understanding by local residents.