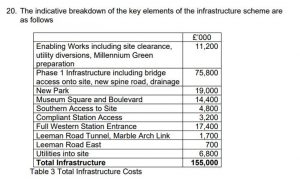

Councillors are rarely asked to make more far reaching decisions than the one they will have to take, about the future of the York Central site, next week. They will approve a £155 million budget to fund “abnormal infrastructure costs” with £45 million of it coming from Council resources. Of this, an additional £35 million will be borrowed.

Councillors are rarely asked to make more far reaching decisions than the one they will have to take, about the future of the York Central site, next week. They will approve a £155 million budget to fund “abnormal infrastructure costs” with £45 million of it coming from Council resources. Of this, an additional £35 million will be borrowed.

The Council has already spent £5.4 million of its existing £10 million York Central budget.

The Council hopes to recover its investment through increased business rates payments generated by the new commercial premises that will be built on the site. It is unclear how national government policy may develop on business rate discounts and planning exemptions for those occupying properties in Enterprise Zones.

The abnormal costs arise from a new access bridge, highway cycle and pedestrian routes into and through the site, a new station entrance, a 5.5 ha park, 3 public squares with enabling ground works, site clearance, remediation and utilities supply.

York Central Partnership (YCP) is a partnership of landowning bodies on the York Central site and is comprised of Network Rail, Homes England National Railway Museum and CYC. Over the last 3 years YCP have developed a comprehensive masterplan for the 72 ha site and are currently awaiting the determination of an outline planning application for the 45ha main site to the west of the railway station, which will deliver up to 112,000 sq. m of commercial space and up to 2500 homes as well as a large park, public squares and an expanded Railway Museum (over a net developable area of c25ha).

A report to Councillors says, “This abnormal enabling infrastructure cost of £155m means that without significant public funding the site is simply not viable and the compound risks of preparing the site for development are not likely to be acceptable to the market. It is therefore proposed that the YCP, having undertaken the enablement and funded the work to date, continue to take the role of infrastructure deliverer for the first phase of infrastructure (CYC) and master developer (NR and Homes England as the predominant land owners on the site), in order to de-risk the project and bring it within viable financial parameters.

Through doing this, the partnership will also exert influence over the timing, nature and quality of development, to optimise fit with policy and corporate objectives whilst respecting the important relationships with local communities, the rest of the city and the historic setting of the site”.

The Council would recover its investment from additional Business Rate income generated by the site. The report forecasts that there could be a maximum cumulative risk to taxpayers of £11.4 million if commercial development is “slow” on the development.

No estimate has been given on the additional annual revenue costs for the Council as the site occupiers start to use public services (e.g. waste collection, lighting etc.) in the City.

The developers do not, at present, have an identified core tenant for the office units.

It is hoped that some residential units on the site may be marketed as early as next year. It is likely to be 2021 before the access roads and bridges are completed.

It is hoped that some residential units on the site may be marketed as early as next year. It is likely to be 2021 before the access roads and bridges are completed.

Any decision by the Council to commit to the expenditure next week will once again mean that there are potential conflicts of interest between the authority as an investor and in its role as an “independent” planning authority.

The Councils record on impartially determining applications in which it has a financial interest (e.g. Lowfields) has been disappointing in recent years

NB. Figures being reported to the same meeting next week reveal that the York Council will – before taking on the above debt – owe £213.1 million. This will increase to £314.2 million by 2022. By the same date, 18% of council tax payments will be used just to to pay interest and principal repayment charges on Council borrowing.