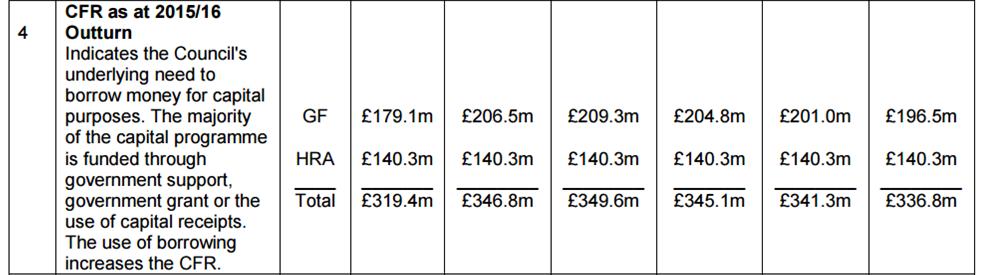

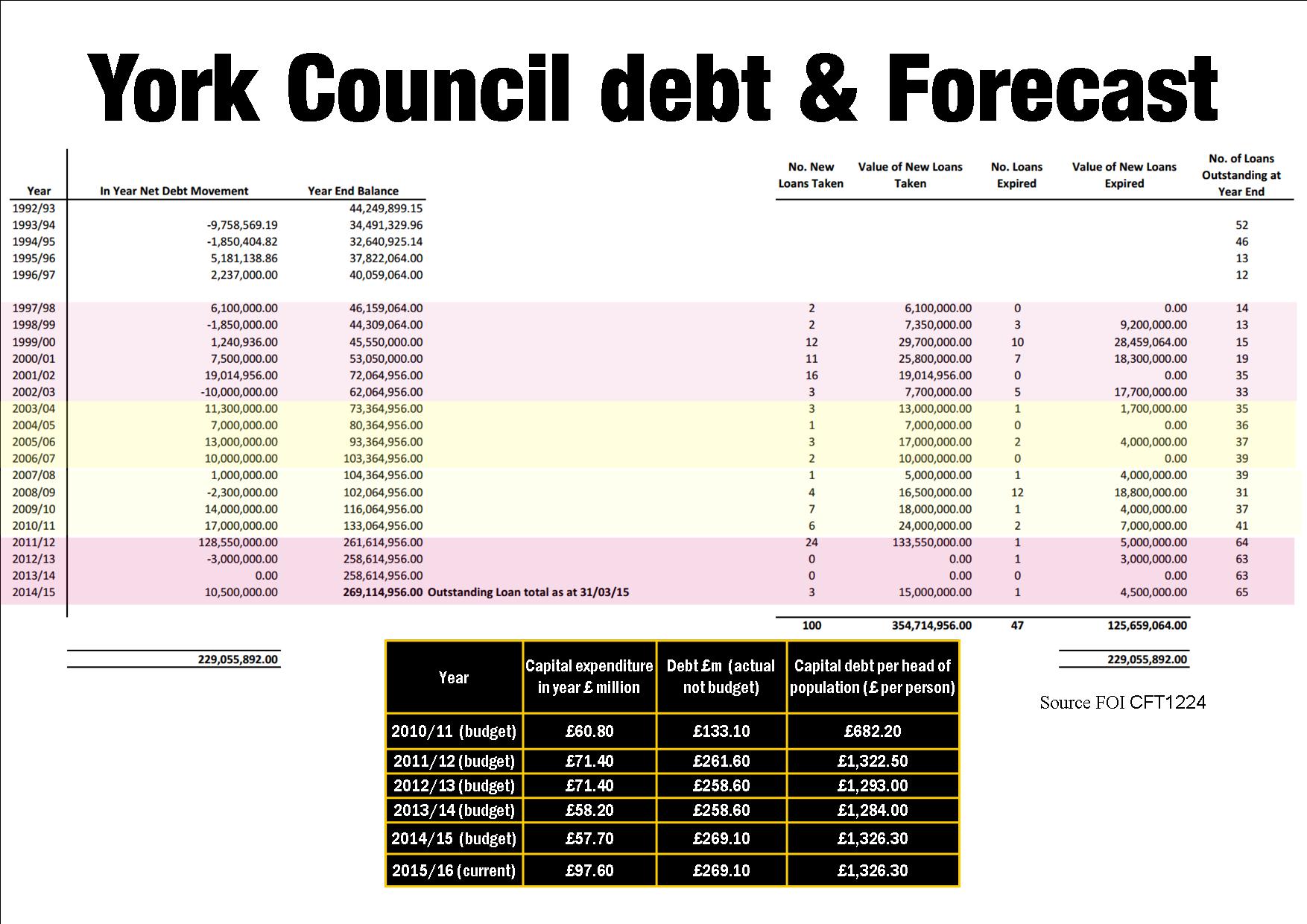

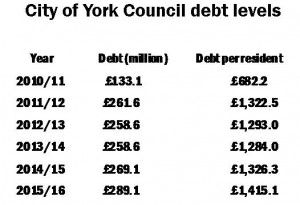

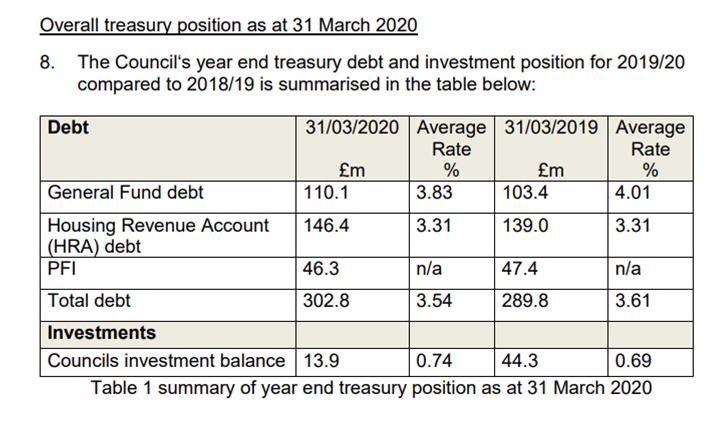

The Councils net debts increased to £289 million in the year up to April 2020.

That was an increase of £43.4 million over 12 months.

The figures are revealed in a report to a meeting taking place this week.

The Council net debts are forecast to increase to £452.4 million within the next 5 years.

This will mean that nearly 25% of Council Tax income will be spent on interest and redemption charges.

The figures don’t take into account the toll that Coronavirus has had on finances over the last 4 months.

Although interest rates are at historically low levels, the Councils income steams have been badly hit. In turn this affects the authorities ability to service its debt charges.

Projects which depend on asset sales for funding are also facing challenges. The commercial property market may be depressed for several years.

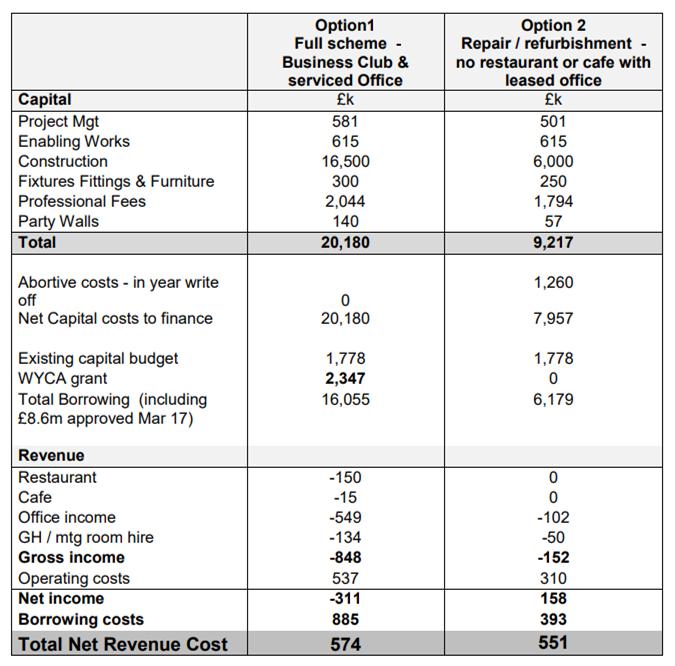

The report fails to provide an update on the assumptions made about commercial letting returns.

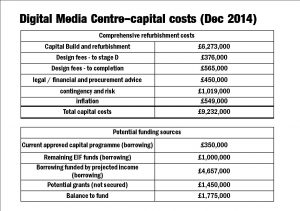

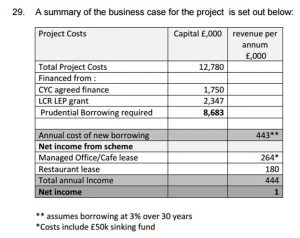

As well as an expanded shops portfolio, the Council has embarked on a series of projects, like the Community stadium and the Guildhall renovation, which depend partly on rent income from office and commercial space to pay for the investment.

Several Council owned offices are currently empty.

The Council, is particularly reluctant to say whether the speculative offices, which it agreed to underwrite at Monks Cross, have yet found a tenant.