It looks like the new Business Rate levels announced by the government on Friday will have little effect in York.

In the main, business rates will increase in London and the south east.

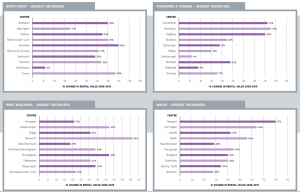

The proposed new rate levels in the north of England are, at worst, steady but some areas – including Scarborough – are set to see reductions.

There were hopes that sub-urban shopping areas in York might benefit from lower rates but this has yet to be confirmed.

In Acomb, some long term empty properties do get a rates discount when brought back into use.

The York Council has so far made no comment on the new valuation lists which it received last week.

Business rates explained

All UK firms pay a tax on the shops, offices, warehouses and factories that they use. All businesses with properties that have a rateable value over £12,000 have to pay Rates. They are the third biggest outgoing for many small businesses after rent and staff costs.

Empty commercial properties brought back into use in Front Street are entitled to a Business Rates discount

Every five years the underlying value of properties is assessed to determine their “rateable value”.

That figure broadly represents the yearly rent – the rentable value – for which the property could be let. The revaluation published yesterday, is based on rentable values on 1 April 2015 and comes into effect on 1 April 2017

The rateable value is then combined with the “multiplier” – a figure set by the government each year – to determine the final bill.

When Business Rates are revalued the government provides a transitional arrangement, to help companies adapt. The transitional arrangement will limit the amount that bills will go up each year, offering a financial cushion that, in the first year, will apply to over 600,000 properties, according to the government.

At the moment, English authorities keep hold of 50% of locally-collected Business Rates. The other half goes into a central government pool and is redistributed back to the local authorities according to need.

The government is working towards allowing local authorities to keep 100% of business rates (with a proportionate reduction in other grants).