The proposal to build a multi storey car park on the St Georges Field site received planning permission yesterday. The car park is intended as a replacement for the Castle Car park which would be grassed over.

We have said before that we believe this site is too far from the City centre shops to help to sustain the retail economy.

The Castle car park is the most heavily used in the City. One key reason is that it is within comfortable walking distance for those carrying heavy items of shopping.

The drift to out of city retail centers would continue with the City centre left as a visitor attraction hub sustaining only, what is left of, the pubs and restaurants that may survive the pandemic

The pandemic has changed all the numbers.

It now simply makes no sense to spend £55 million on a scheme which could lose the City much needed jobs

The Council should shelve the plans. They should not be bought off by government financial bribes. The country needs to invest wisely to maximise economic recovery.

The City can tolerate the Castle car park for another decade.

In the interim, the Council can make plans which recognise that personal transport will remain a popular method of moving people from the suburbs and region into the City centre. It is a matter of individual choice.

In future the vehicles used may, however, be battery powered.

The idea of having the area, within the inner road road, designated as an Ultra Low Emission Zone (ULEZ) may well be one that has now found its time.

The move to home working – and with it greatly reduced congestion and emission levels in the central area – provides the Council with some thinking time.

A quieter City centre would be bad news for many service based shops, hair dressers etc., They will be hoping that visitors would expand to fill the gap in trade left by office workers.

The Councils draft budget for 2021/22 anticipates a £375,000 saving on office costs – a clear indication that the authority itself believes that many staff will never return to West Offices. The same will be true of other City Centre companies

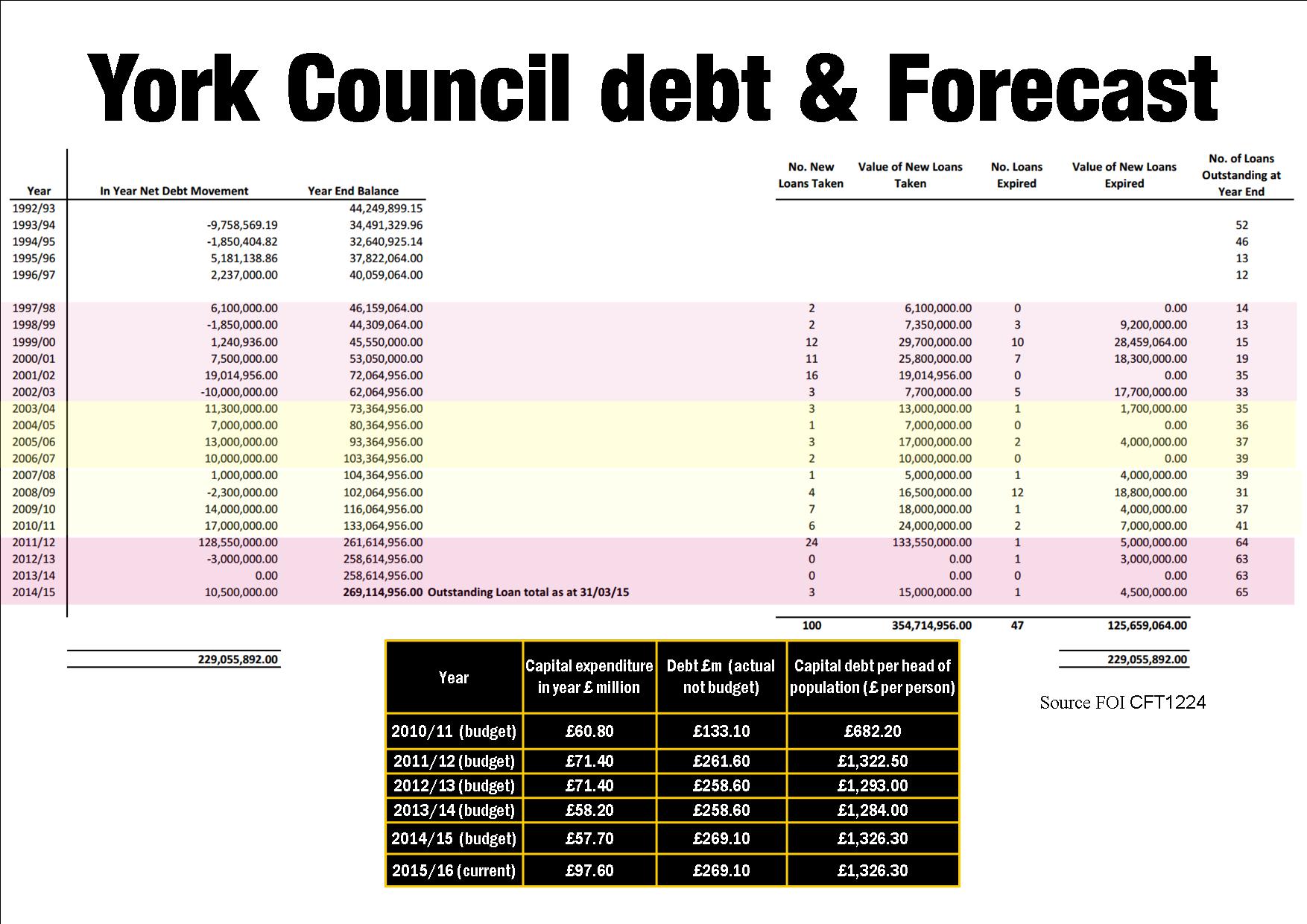

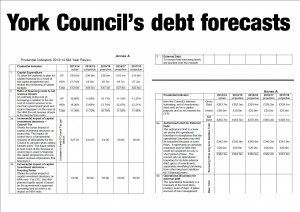

The Councils budget also contains a commitment to borrow £2.5 million to spend on the Castle Piccadilly scheme. In addition the £28.2 million proposals to construct flats at Castle Mills are budgeted separately

That would simply add to the additional interest and redemption costs of £1.6 million which will account for much of the 1.9% increase in Council Tax levels from 1st April. (The remaining 3% hike is earmarked for social care).

So time now for some prudent revisions to the Councils investment plans.

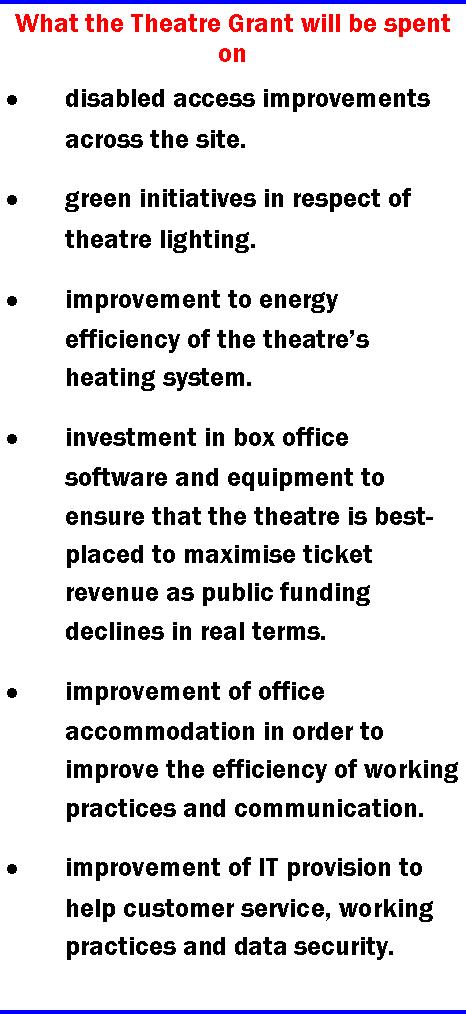

The York Council is expected next week to confirm an additional grant of £1/2 million to the Theatre Royal.

The York Council is expected next week to confirm an additional grant of £1/2 million to the Theatre Royal.