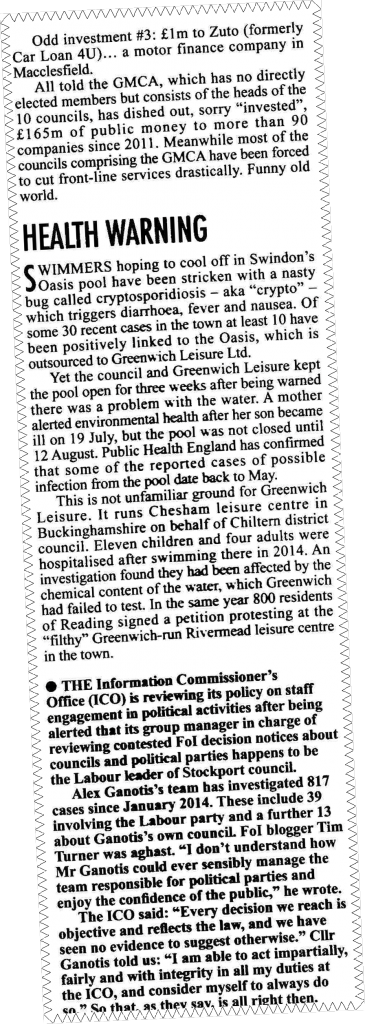

The proposed operator of the Council’s indoor sports facilities is under fire in some parts of the Country over safety standards.

Private Eye magazine 2nd Sept 2016

According to Private Eye magazine (right) Greenwich Leisure has been slow to respond to complaints of tainted water in one of its pools in Swindon.

Greenwich Leisure is a not for profit “community interest company” which ran the Waterworld leisure centre on behalf of the council before it was demolished as part of a larger project to build a new community stadium.

Use of Waterworld declined rapidly and the, then Labour led, authority made additional subsidy payments to the operator between April and November 2014 to keep the pool open.

The payments were later subject to an auditor’s report.

Greenwich Leisure were appointed as the preferred contractor not only for the Stadium and associated swimming pool and sports centre but also the Yearsley pool and Energise sports centre on the other side of the City.

We reported in August 2014 that increasing costs were threatening the future of the Community Stadium complex. Things have deteriorated further since then with planning permission for additional commercial development now subject to a Judicial Review.

It has been clear for several years that the increasing size and complexity of the project has jeopardised not only the interests of taxpayers but has even brought into question whether some sports facilities in the City may also now face closure.

Recently the Council agreed to subsidise the use of Bootham Crescent by the Rugby Club until the new stadium has been completed. It is unclear how much this will cost taxpayers.

The York Council has yet to comment on the reports about swimming pool safety.