The York Council is expected next week to confirm an additional grant of £1/2 million to the Theatre Royal.

The York Council is expected next week to confirm an additional grant of £1/2 million to the Theatre Royal.

The plan – which will be classified as “capital expenditure” and will increase the Councils already large capital debt – was revealed during the recent budget debate.

The report to the decision meeting which take place on 16th March is unsatisfactory in several respects. It fails to include essential information about the Theatres financial performance.

As a minimum the 2018/19 outturn, the 2019/20 and the (draft) 2020/21 budget should be made public. At the moment taxpayers have no idea whether the Theatre is profitable or not (probably not!).

There is no detail of the Theatres medium term business plans. There is no comment from the York Councillors (Crawshaw, Daubeney, Mason) who are supposed to look after the Council and residents’ financial interests on the Theatre Board

In 2015 the Council decided to sell the Theatre Royal building to the York Conservation Trust for £1. The Trust is a benign body which agree to make a major investment in essential repairs. The Council said that it planned to stop its annual support grant to the Theatre but instead agreed to make a contribution of £770,000 towards a £4.1 million restoration project. This project was intended to make the Theatre self-supporting. The Council’s responsible executive member told the York Press in February 2016 “This funding agreement will strengthen York Theatre Royal’s sustainability for the future”

Theatre Royal refurbishment 2016

The refurbishment overran its timescale and the Theatre was effectively closed for nearly a year.

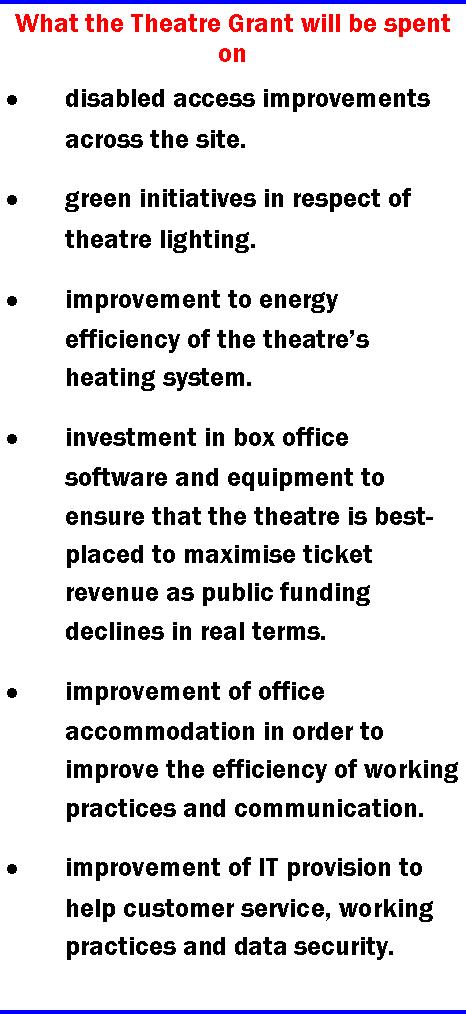

The most worrying aspect of the new deal is the decision to borrow money to fund it. The Council report says that the £500,000 borrowing will cost taxpayers “£35,000 a year” in interest charges and principal repayments. Only if the Council borrows the money over a 20 year term. Some of the proposed expenditure (IT, box office software) will be on items with an expected lifetime of less than 7 years. Borrowing money over a period longer than the life of an asset would be financial madness.

A more realistic borrowing time-frame would be 10 years, meaning taxpayers would be committed to ongoing payments of around £65,000 a year.

NB The Council aggregates all its borrowing requirements and currently enjoys interest payments on its borrowings of less than 5%

Then there is the question of whether more investment will be sought in 4 years time?

The Council should not agree the expenditure without publishing a lot more information about the financial trajectory for the Theatre.

In the event of it ceasing trading, most of the taxpayer investment would be unrecoverable.

The demise of the Rose Theatre last year has already left the York taxpayer with a £40,000 plus bill.

It could be viewed by the Council as a timely warning about the need for prudent and well informed decisions.