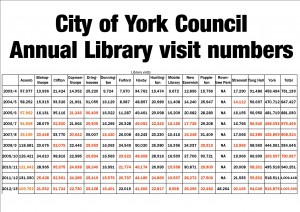

Overall use of York’s libraries fell by over 3000 last year.

However just over 1 million visits were recorded which is still above the average for City’s of a similar size.

Every Library in the City except Fulford showed a reduction.

The overall fall would have been even greater had it not been for the newly opened Rowntree Park library which attracted nearly 50,000 users. However the new library depended on a large number of special events to attract visitors and it is too early to judge its long term attractiveness.

It appears that the Council has taken its eye off the ball recently with the controversial plan to privatise the library service having apparently affected staff morale while at the same time monopolising senior management time.

Even Labour Party supporters are unhappy with this plan with one member taking the opportunity to speak against the proposals at the last Council meeting.

The concern is that Labour are trying to distance themselves from the library service before reducing the subsidy available (and thereby forcing closures).

The largest drop in numbers was at the Acomb Library. This may be because special events – such as evenings with prominent authors – have been fewer in number recently.

A plan to locate Council customer facing staff from the housing and neighbourhood teams at the library was scrapped by Labour when they took office in 2011. This made it more difficult for the building to become the “hub” for activities in the Acomb area.